The client approached us with a request to promote a website in a highly competitive niche dominated by established players.

At the start of the project, we identified numerous issues, including stagnant traffic caused by an ineffective previous SEO strategy and a toxic backlink profile that posed a risk of penalties. To solve these problems, we jointly agreed to migrate the website to a new, clean domain. This allowed us not only to preserve existing performance metrics but also to build a solid foundation for long-term growth.

Today, the client’s website attracts new audiences and ranks higher in search results. This case illustrates how a comprehensive, well-planned strategy can change a business’s growth trajectory in a challenging and competitive niche.

About the Client

The company’s main advantage is its large physical warehouse-store, the biggest in the city, where customers can visit, view products in person, make a purchase, and take their order home immediately. The business combines the convenience of an offline store with the speed of an online service, offering fast customer support and same-day shipping.

The company offers a wide range of aluminum products, including:

- Standard profiles (T-shaped, L-shaped, U-shaped, and others).

- Angles.

- Machine profiles.

- Rods.

- Pipes.

- Baseboards.

- Sheets and plates.

The company is committed to providing high-quality products at competitive prices by regularly running supplier tenders. Its approach is centered on delivering both individualized service and comprehensive solutions tailored to each customer.

Company services and advantages:

- In addition to sales, the company provides a full range of processing and logistics services.

- Capability to manufacture complex aluminum structures at its own production facility.

- Consistent availability of a wide assortment in stock.

- Fast delivery for custom orders.

- Ability to choose products from multiple manufacturing plants.

Niche characteristics

- Market type. This is primarily a B2B market, meaning most customers are other companies (construction firms, furniture manufacturers, architectural studios, etc.). End consumers make up a smaller portion of the audience. This requires a specialized approach to sales and marketing.

- The niche is highly competitive. It includes both large manufacturers (with their own production facilities) and smaller trading companies. This means that successful promotion requires identifying unique advantages or targeting a narrow specialization.

- Clients. Buyers are professionals who need detailed technical information. They are not purchasing “just a profile”; they choose based on alloy type, dimensions, coating options, corrosion resistance, and more. This requires expert-level content: high-quality product descriptions, technical specifications, certifications, and professional consultations.

- SEO and search queries. High-frequency queries such as “aluminum profile” are highly competitive. Therefore, effective SEO requires focusing not only on these terms but also on less competitive queries and long-tail keywords.

Success in this niche depends on a deep understanding of B2B client needs, strong product expertise, and the ability to manage business processes flexibly while accounting for seasonality and economic risks.

Initial data

For about four years, the client had been working with another contractor periodically, who eventually could no longer deliver further growth in organic traffic. The company approached us to determine whether there were still opportunities to increase website traffic through search engines.

The primary SEO task was to enhance the website and increase its visibility in search results.

The main goal was to achieve top search positions and drive sales growth. The client also requested visual improvements to make the website look more modern.

What we had at the start of our collaboration:

- spot-focused SEO efforts over the previous four years;

- 3 copies of the website;

- a profile on prom.ua.

The issue of affiliate sites (duplicates) and associated risks

The presence of three copies of the website posed a serious technical problem and carried significant SEO risks.

- The risk of devaluation. Search engines could downgrade the duplicate sites if they detected that the copies were created to manipulate ranking algorithms. Separating the sites became a key step in avoiding penalties and preserving their positions in search results.

- Internal competition. Each copy functioned as a standalone website. Instead of concentrating the site’s authority (traffic, backlinks) in one place, it was dispersed across three different versions. This fragmentation could negatively affect overall profitability.

The optimal solution. Separating the affiliate sites not only helped avoid risks from search engines but also allowed us to focus all marketing efforts on a single, most effective resource.

Domain

Important. The client’s website was hosted on a domain written in Cyrillic. During the preparation of the commercial proposal, we recommended switching from a Cyrillic domain to a Latin-based one.

- Technical advantages. A Latin-script domain name is more common and universal across the web. It simplifies processing, indexing, and ranking by search engines and eliminates potential encoding issues that may occur when Cyrillic characters are used in URLs.

- Marketing advantages. A domain like website.com.ua is easier to understand, remember, and type than a Cyrillic domain such as website.ukr (вебсайт.укр).

- Backlink profile. Latin-script domains simplify link-building efforts because URLs remain readable and consistent when copied or shared across different platforms.

Our recommendation to switch domains became even more relevant after a detailed niche analysis. The entire subsequent promotion strategy was built around this key decision. Migrating to the new domain, website.com.ua, became the foundation for all further optimization efforts and traffic growth.

Search traffic

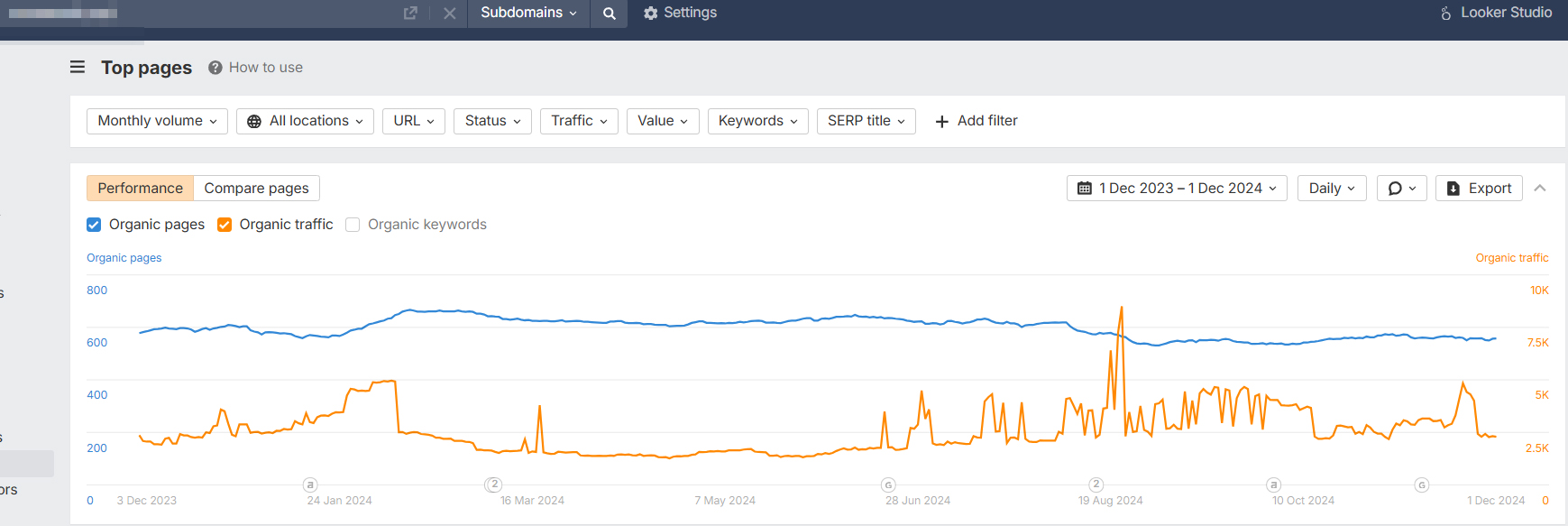

For most of the year, the website’s organic traffic fluctuated between 2,500 and 4,000 users. There was no stable upward trend, indicating that the previous SEO strategy had reached its limit and was no longer driving growth. The number of organic pages remained relatively unchanged throughout the period, suggesting that either new content was not being added or was not being properly optimized for search engines. A static number of indexed pages typically leads to traffic stagnation. The graph shows two noticeable traffic spikes, with one powerful surge at the end of August 2024. However, after each spike, traffic quickly returned to its previous level. These short-term increases were likely caused by seasonal demand or temporary ranking improvements that could not be sustained over time. The absence of steady growth confirmed the need for a new promotion strategy.

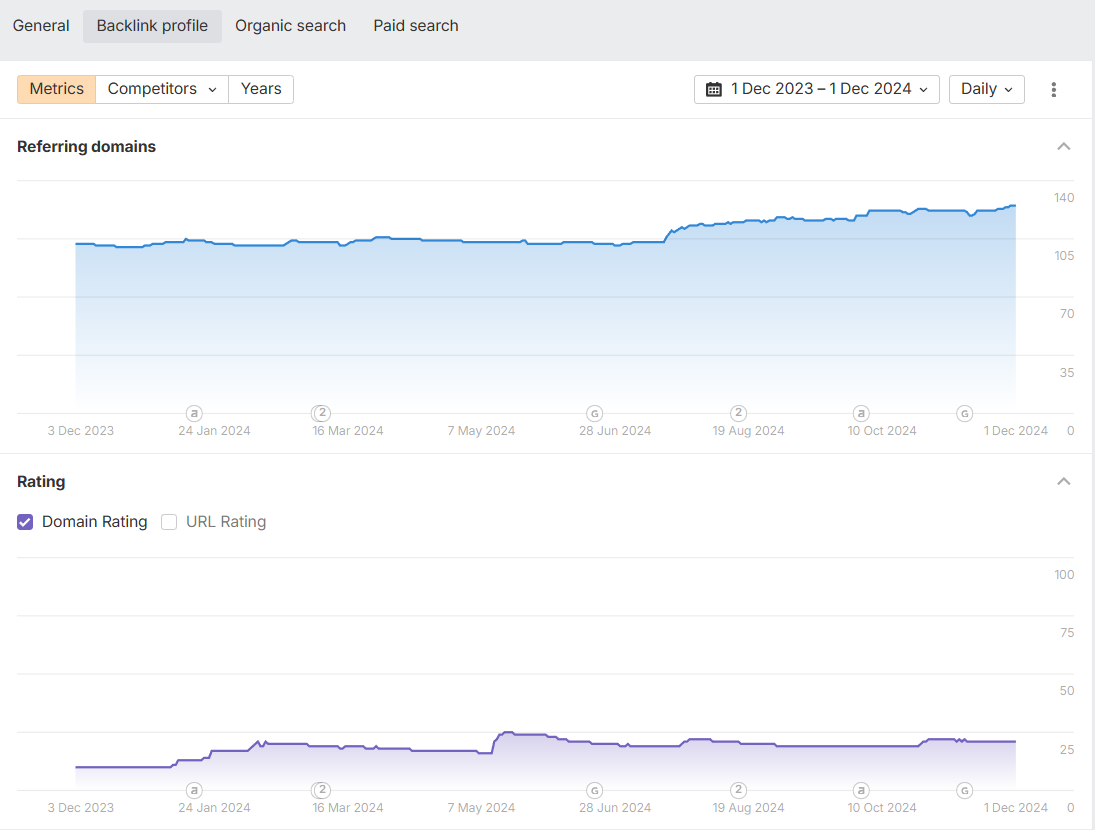

The number of referring domains before our work with ITForce began.

The website had between 110 and 140 referring domains. From the screenshot, we saw no stable upward trend, indicating the absence of an active, targeted link-building strategy. Minor fluctuations indicated that new links occasionally appeared, but not in sufficient quantity to influence overall performance.

The domain rating remained low. Although there was a slight increase, the DR consistently ranged between 20 and 30, a relatively low value for such a competitive niche.

As a result, the website was unable to break into the top search results or increase traffic, despite the previous contractor’s efforts.

The graphs clearly demonstrated stagnation. The site was neither losing ground nor progressing. This fully aligned with the client’s initial concerns and confirmed the need for a new approach.

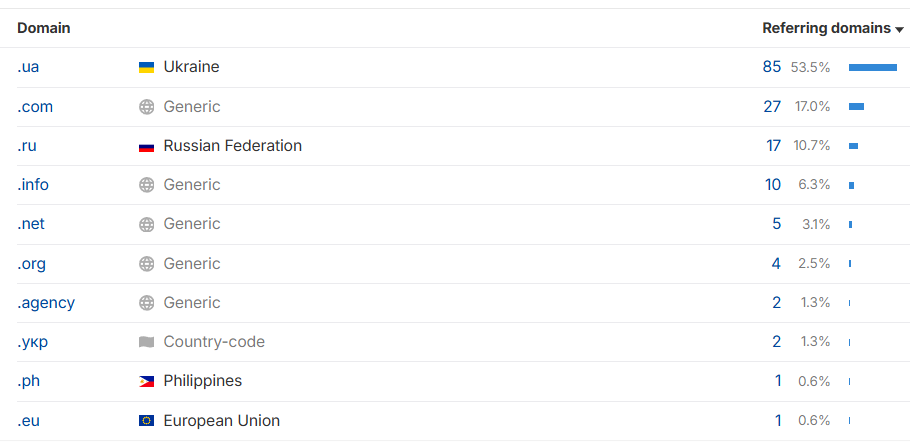

Domain zones:

53.5% of referring domains were Ukrainian (.ua), which was a positive signal since the website targets the Ukrainian market. Links from local resources are more relevant to search engines.

Global domains (.com, .info, .net, .org) accounted for about 28%. This is normal and contributed to the overall authority of the backlink profile.

Russian domains (.ru) made up 10.7%, which was a negative element in the link profile. Links from domains belonging to an aggressor country can be viewed by search engines as toxic or irrelevant, particularly for businesses focused on the Ukrainian market. These links should be removed using the Google Disavow Tool. This became an additional reason to change the website’s domain name.

Workflow

Niche and competitor analysis

In the aluminum profile market, the leading websites optimize and promote category pages based on user intent, which in this niche is predominantly commercial (for example, “buy”). This allows users to find the product they need quickly. In practice, category pages must contain the relevant products and offer convenient filters that help users search for and purchase the right item.

In search results, Homepages also appear in the TOP, but they rank lower because they do not fully match the intent of potential customers. They do not display the exact products the user is looking for and instead act as a showcase with multiple categories. Since they do not serve as a direct point of purchase, search engines consider them less relevant, which negatively affects their ranking.

Based on our analysis of top-ranking pages, we concluded that competitors focus on promoting categories and subcategories within the core direction “aluminum profile”. Search engines consider category pages far more relevant for product-specific queries.

Our first task was to collect the semantic core for the main priority categories and then determine how to adjust the Homepage, specifically, whether the primary semantics should be shifted to a target category page. After that, we prepared recommendations for optimizing the Homepage (updating the banner, improving category blocks, and highlighting popular products and services). We passed them on to the client’s team for implementation.

Current rankings. The website was already among the top three market leaders for aluminum profile products, indicating strong authority and relevance. There was significant potential to further promote the core categories and subcategories of aluminum profiles. Optimizing these pages for commercial user intent, along with adding convenient filters and up-to-date products, would help the site secure leading positions in search results.

A comparative competitor analysis provided us with the following insights:

- Domain age: ranges from 7 years to 14 years 10 months.

- Number of indexed pages: from 3,080 to 53,000 pages.

- Monthly traffic: from 2,700 to 7,600 visits.

- Number of ranking keywords: from 680 to 1,600 keyword phrases.

- Queries in Google’s Top 10: from 105 to 352 queries.

- CMS: WordPress, OpenCart.

- Social media: Instagram, Facebook, YouTube. One competitor has no social media presence.

- Language versions: all competitors offer Ukrainian and Russian versions; some also have English.

- Blog: All competitors have either a Blog or a News section, but not all update these sections regularly.

- Filters: 2 competitors have a product filtering system.

- Infinite scroll: none of the competitors use it.

- Aluminum processing services: all competitors provide this service.

Competitors are established players in the market, as evidenced by the age of their domains (up to 14 years). This indicates a mature niche where successful promotion requires substantial effort and investment.

All competitors maintain blogs or news sections, highlighting the importance of informational content for attracting traffic. They actively showcase their expertise to build trust with potential customers.

Having product filters by technical characteristics is a standard in this niche, as it simplifies the search process for B2B clients.

The absence of infinite scroll among competitors indicates that classic pagination is more effective both for search engine indexation and for user convenience.

Competitor backlink profiles

- The competitors’ domain ratings range from 7 to 19.

Monthly traffic varies from 2,800 to 10,000 visitors.

Number of backlinks and referring domains:- The number of backlinks pointing to the homepage ranges from 27 to 790.

Total backlinks range from 503 to 2,000.

The number of referring domains varies from 85 to 413.

- The number of backlinks pointing to the homepage ranges from 27 to 790.

- Backlinks to the Homepage: the share of homepage backlinks among competitors ranges from 5.4% to 92.6%.

- Types of backlinks:

- The proportion of dofollow backlinks dominates for most competitors, from 41% to 73%. This is optimal, as dofollow links pass authority to the site.

- The share of nofollow backlinks ranges from 27% to 59%.

The market is competitive, but it lacks dominant players with exceptionally high domain authority. The site with the highest traffic (10,000 visits per month) actually has the lowest DR (7), which indicates an effective SEO strategy focused on content quality and relevance, or the use of additional traffic channels not directly tied to the backlink profile. There is a significant gap in backlink volume among competitors. The highest number of links (2,000) belongs to a site with DR 18, which may suggest an aggressive link-building strategy. The site with the largest number of unique referring domains (413) has a DR 19, underscoring the importance of link diversity. An excessively high percentage of backlinks pointing only to the Homepage may indicate a lack of a balanced link-building strategy and insufficient distribution of link equity across internal pages. The backlink strategies of competitors vary widely from balanced approaches (linking to a broad set of internal pages) to riskier ones, where almost all backlinks point to the Homepage.

The steady growth of backlinks among both competitors and our client over the past year indicates an active market struggle. All major players have developed and are executing long-term external promotion strategies, making link-building a critical area for further growth.

To build an effective link-building strategy, it is important to focus not only on the number of backlinks but also on their quality and diversity. Equally essential is distributing link equity across internal pages rather than concentrating almost all links on the Homepage.

Our recommendations for increasing CTR and conversions

Design and UX improvements

- Design - update the site’s design with targeted improvements to make it look more modern and visually consistent.

- Product display - enable permanent product images on category and subcategory pages. Currently, images appear only when hovering, which reduces clarity and usability.

- Functionality:

- Enable filters for key product characteristics. This will improve the user experience and create opportunities to optimize filtered pages - a tactic that, based on competitor analysis, can generate additional traffic.

- Replace infinite scroll with pagination across all product pages. This will improve indexation because each page will have its own URL, and it will also make navigation easier for users who want to return to a specific page.

Technical optimization

- Affiliate websites - separate all affiliate sites and remove backlinks to the main domain after a detailed audit.

Technical site audit

Technical optimization and indexation - identified issues:

- Robots.txt and indexation (create a proper robots.txt file to block non-essential pages from crawling).

- Sitemap (add the missing 31% of pages to the sitemap and enable automatic updates).

- Block search results and technical pages from indexation (including registration, login, cart, and account pages).

- Redirects (configure 301 redirects from the old domain, reduce unnecessary internal redirects, and fix language-switcher redirect issues).

- A large number of broken links with the /tracking= parameter.

- Broken links and missing images.

- Missing canonical tags (add rel="canonical" to pagination pages and set canonical tags where they are absent).

- Page speed optimization.

- Fix internal redirect chains.

- Create an effective 404 error page and resolve 404 errors on the old domain.

- Fix pages returning a 403 status code.

Content and site structure

- Create pagination pages instead of using infinite scroll.

- Meta tags and H1(generate unique meta tags and <h1> headings for pagination pages using a dynamic template).

- Remove excessive or inconsistent H2 and H3 headings that are used for layout instead of structure.

- Adjust meta tags on selected pages to prevent Homepage cannibalization.

- Correct missing or duplicated metadata, including title, description, and H1.

- Move the <h1> heading on the Homepage to a correct position and align the <h1> headings across language versions.

- Optimize on-site images by adding ALT and Title attributes and updating outdated formats such as JPEG and PNG where possible.

- Implement structured data for language versions, images, products, and reviews.

Functionality

- Fix the product display so that items remain in grid view instead of switching to a list after clicking “Show more,” and adjust price sorting.

- Update the menu so that links to categories without products are not clickable.

- Add “Return and Exchange Policy” and “Privacy Policy” pages with the correct email address.

- FAQ: add an FAQ section to the Homepage and enable text editing for FAQ blocks on category pages.

- Reviews: add the ability to display a view counter and the number of reviews on the product page.

- New elements: add product variations directly on product cards and introduce a “Frequently bought together” block.

- Fix text display issues, meta tags, and Open Graph data on the language versions of the Homepage.

- Remove duplicate products and invalid pagination pages in the /page- format.

- Handle the generation of pages with dynamic parameters such as /?tracking=.

Language versions and localization

- Add the x-default attribute to the hreflang.

Usability audit

Technical and functional issues

- Forms and navigation:

- Fix errors that prevent forms from being submitted.

- Correct broken links in the footer.

- Mobile version and responsiveness:

- Fix display issues on the mobile version of the site.

- Resolve content display problems on language versions of pages.

- Product display and functionality:

- Improve the appearance of product formats when sorting.

- Correct issues with product images.

- Fix product titles displayed in the Homepage preview blocks.

- Add a product comparison feature.

- Add a wishlist feature.

Content and interface

- Homepage:

- Adjust the visual layout of the Homepage, including the banner and category tiles.

- Navigation:

- Keep the cart visible while scrolling.

- Add breadcrumbs to product pages.

- Localization and contentт:

- Ensure the success message displayed after registration matches the selected language version of the site.

- “Company” section:

- Add content to the “Company” section, including information about the team.

Google My Business (GMB) optimization)

Based on the GMB profile analysis, we provided the following recommendations for implementation.

- Profile:

- Add services to the GMB profile.

- Content:

- Update the company description in GMB.

- Optimize GMB images with geotags.

- Add links to social media profiles.

- Customer interaction:

- Respond to customer reviews.

- Publish promotions, updates, and events regularly.

Content updates:

- Refresh and update product cards.

- Update the “Reservation” section.

- Update the company description on the website.

Blog analysis

Technical optimization

- Redirects:

- Set up 301 redirects from articles identified as irrelevant to more appropriate or related content.

- Configure a 301 redirect from the URL parameter ?filter_tag= to the main Articles section.

- Metadata:

- Set up metadata for pagination pages.

Content and usability optimization

- Article structure:

- Add a table of contents at the beginning of each article.

- Set up internal linking to other relevant articles.

- Social interaction:

- Add social media “share” buttons below articles.

- Remove the comment form from article pages.

- Layout and navigation:

- Update the article list using current banner designs.

- Add a “Popular Articles” block to the Homepage.

We organized all identified issues by priority and sent them to the client’s team for review and implementation.

The website migration to the new domain was carried out in close collaboration with the client’s technical specialists. We provided expert guidance and support to ensure a smooth transition without complications.

We began by working through category and subcategory pages based on the client’s priorities. These pages were identified as the primary assets that would rank for the core and most competitive search queries.

Tools used

In our work, we rely on Seranking, Serpstat, Ahrefs, Screaming Frog, and Google Search Console. These tools helped us identify keyword cannibalization across categories, subcategories, and product pages, and develop a strategy to resolve it. On May 16, we identified a critical technical issue that caused metadata, Open Graph tags, and page texts to appear in the wrong language versions. As a result:

- Search engines ranked keywords incorrectly because Ukrainian pages could be interpreted as Russian, and vice versa.

- Positions dropped significantly due to this confusion in language signals.

The issue was detected and fixed quickly, minimizing its negative impact. Correcting the error restored proper ranking for each language version, which was essential for future traffic growth.

General SEO activities for the project

Technical audit and optimization

- Audit and usability:

- Conduct a full technical audit and usability analysis.

- Verify the implementation of technical recommendations and usability improvements.

- Domain migration:

- Provide recommendations for migrating to the new domain.

- Prepare a redirect map for the site copy and for removed categories or products.

- Work with GSC and indexation:

- Analyze indexation errors in Google Search Console.

- Verify the completion of technical tasks related to crawling and indexation.

- Filter optimization:

- Analyze existing filters and review competitor filter setups.

- Prepare and oversee the implementation of tasks required to introduce new filters.

Content and semantics

- Semantic core (SC):

- Collect the semantic core for priority pages, filters, and core product directions.

- Content:

- Review and provide recommendations for updating the Homepage and the “Mounting hardware for solar panels” category.

- Analyze and deliver recommendations for the blog and GMB profile.

- Check existing texts for alignment with the semantic core and provide recommendations for improvements.

- Metadata:

- Create meta tags for pages based on the collected semantic core.

- Upload and implement meta tags and content on the site.

- Work with copywriters:

- Review copywriter texts to ensure they meet the technical specifications.

- Prepare technical briefs for writing content for internal and external resources.

Link building

- Link marketplaces:

- Select high-quality donor sites and purchase permanent backlinks.

- Crowd marketing and submissions:

- Prepare technical tasks for the link builder for crowd links and submissions.

- Review completed link-building tasks and prepare reports.

Analysis and reporting

- Monitoring:

- Analyze the site’s ranking positions.

- Review and adjust the link-building strategy when needed.

- Monitoring:

- Prepare detailed reports on completed work.

Search promotion results

We remind you that the website migration to the new domain took place on February 25, 2025. As expected, there was a temporary decline in rankings and traffic. Our main task during the migration was to preserve current positions and maintain the existing level of visibility.

Reindexation

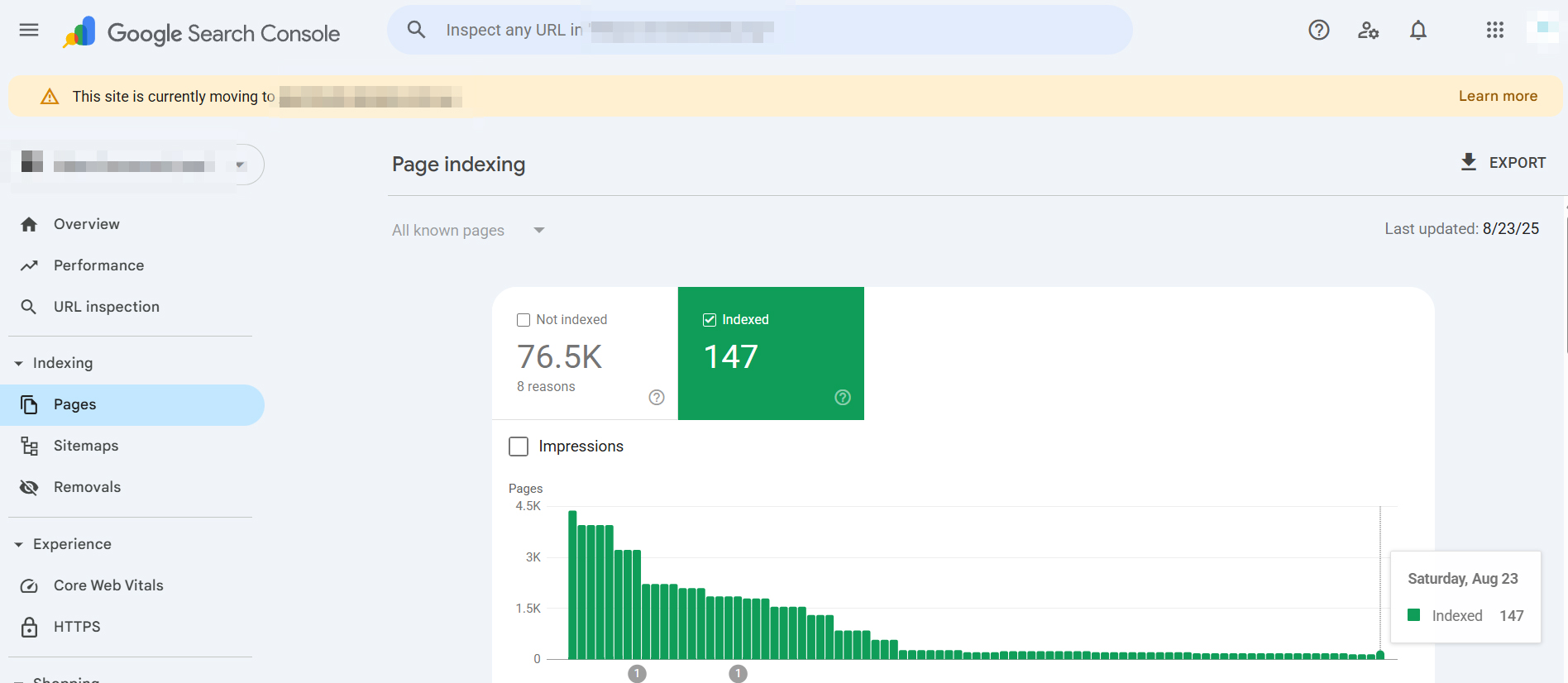

The migration to the new domain is almost complete, which is confirmed in Google Search Console.

- Indexation. The Indexed graph shows that the reindexation process is nearly finished. The latest peak on the graph indicates 147 indexed pages on the new domain.

- Deindexation. The Not indexed graph shows 76,500 non-indexed pages. This demonstrates that Google is actively deindexing pages on the old domain because they were redirected to the new one.

- Impressions. The Impressions graph confirms the same trend. The number of impressions for the old domain is dropping rapidly, which is expected. It shows that traffic and impressions are shifting to the new domain, the primary goal of the migration.

As of August 2025, the migration to the new domain is progressing successfully. The deindexation of the old domain and the transfer of authority to the new one are now in their final stages.

Website clicks and impressions

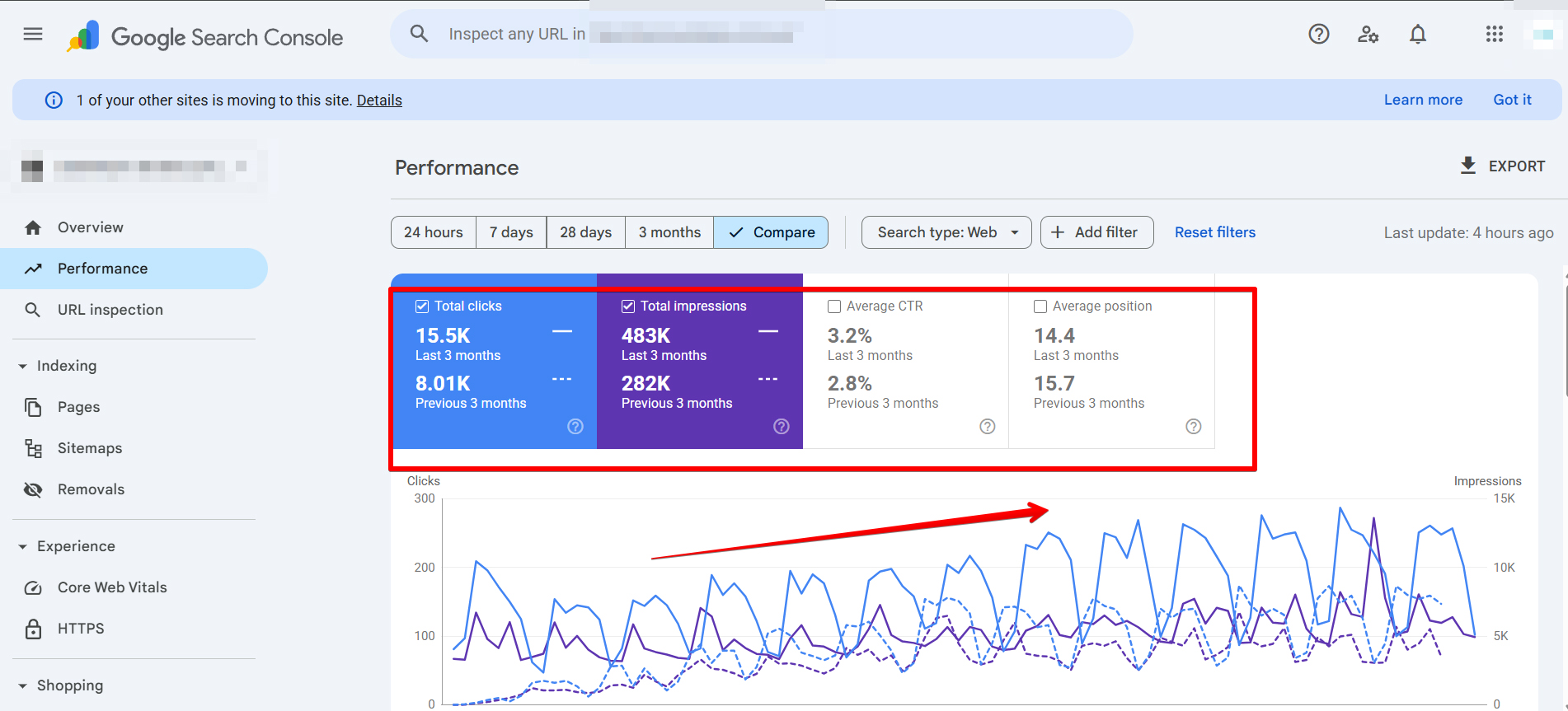

Statistics for the past three months:

- Total clicks. The screenshot shows that the number of clicks has almost doubled. This means the website is effectively attracting users from search.

- Total impressions. Impressions have also nearly doubled. The site’s visibility is expanding, and it is ranking for a wider range of keywords.

- Average CTR. CTR increased by 0.5%. This indicates that page titles and descriptions have become more appealing and relevant to user queries, driving more traffic to the website.

- Average search position. The average position improved from 15.7 to 14.4. This indicates steady upward movement in search results, bringing the site closer to the first page.

Overall, the graph shows a clear upward trend in both clicks and impressions — something that was not observed on the old domain. This proves that the new search strategy is working effectively. Website rankings also increased after the issue detected on May 16 was fixed, and keyword cannibalization has almost disappeared.

Organic traffic

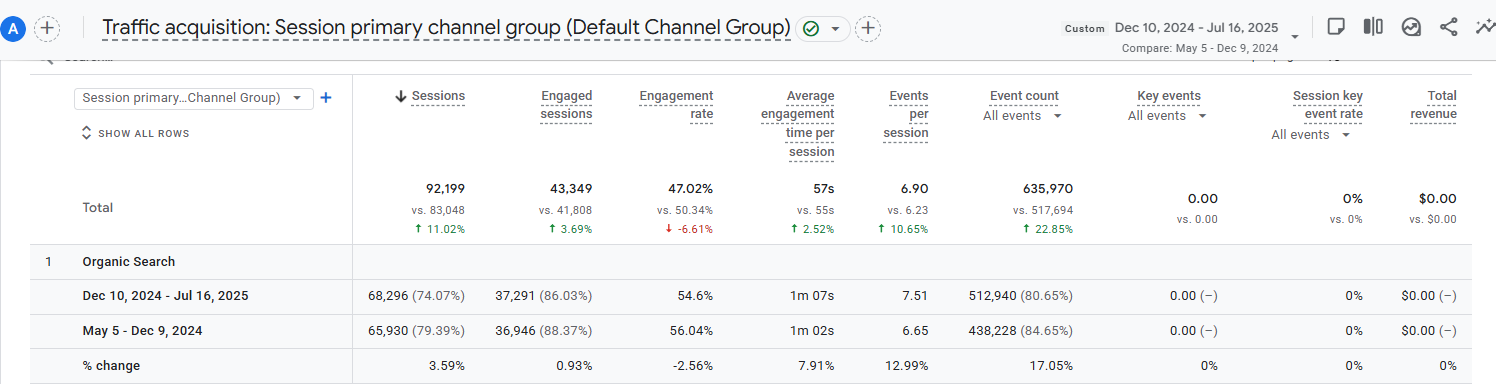

We compared the current period (December 2024 - July 2025), which includes the domain migration, with the previous period before the move.

- +3.59% in visits

- +0.93% in engaged sessions

- -2.56% in engagement rate

- +7.91% in average engaged session duration

- +12.99% in events per session

- +17.05% in total events

These metrics show that, despite the domain migration and the temporary volatility it usually causes, user activity on the site continues to increase. The increase in session duration, events per session, and total events suggests deeper interaction with the content and improved overall quality of user engagement.

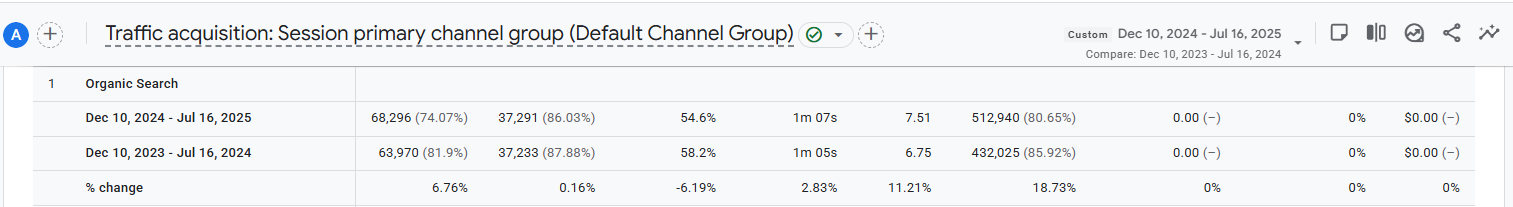

When comparing the current period with the same period last year:

Organic search sessions increased by 6.76%. This growth is especially significant given the planned drop after the domain migration and the recent technical issues. Despite the turbulence and keyword cannibalization on multiple pages, we still achieved positive momentum. The engagement rate decreased slightly, which may be the result of overall traffic growth and the influx of new users who are still getting acquainted with the site. Average engagement time increased by 2.83% a positive indicator showing that users find the content relevant and spend more time on the website. Total events increased by 18.73%, meaning visitors are interacting with the site more actively, which is one of the key goals of SEO.

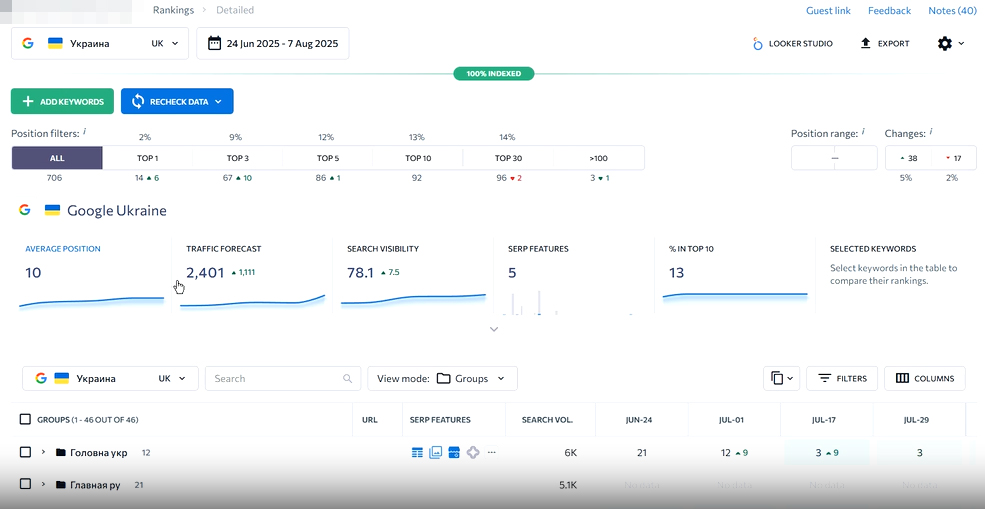

Ranking positions

- 14 queries in the Top 1;

- 13% in the Top 10;

- 10 - the average position in search results (which corresponds to Google’s first page);

- 78.1% search visibility.

13% of all tracked keywords now appear on the first page of Google. The projected traffic is 2,401 monthly visits, with an increase of 1,111. This confirms that the website is rapidly gaining organic traffic after the domain migration. The 7.5% increase in projected visibility indicates that the site holds strong positions across a wide range of keywords. We now have 38 keywords in the Top 10 and another 86 in the Top 5 - a substantial improvement that demonstrates the effectiveness of the updated SEO strategy. One keyword group shows extreme dynamics: queries that were at position 21 on June 24 rose to position 12 by July 1, then to position 9 on July 17, and reached position 3 on July 29. This is direct evidence of a successful migration and improved search visibility.

The data from the screenshot confirms that the SEO strategy is working effectively. After migrating to the new domain and resolving technical issues, the website not only recovered but also significantly improved its search positions.

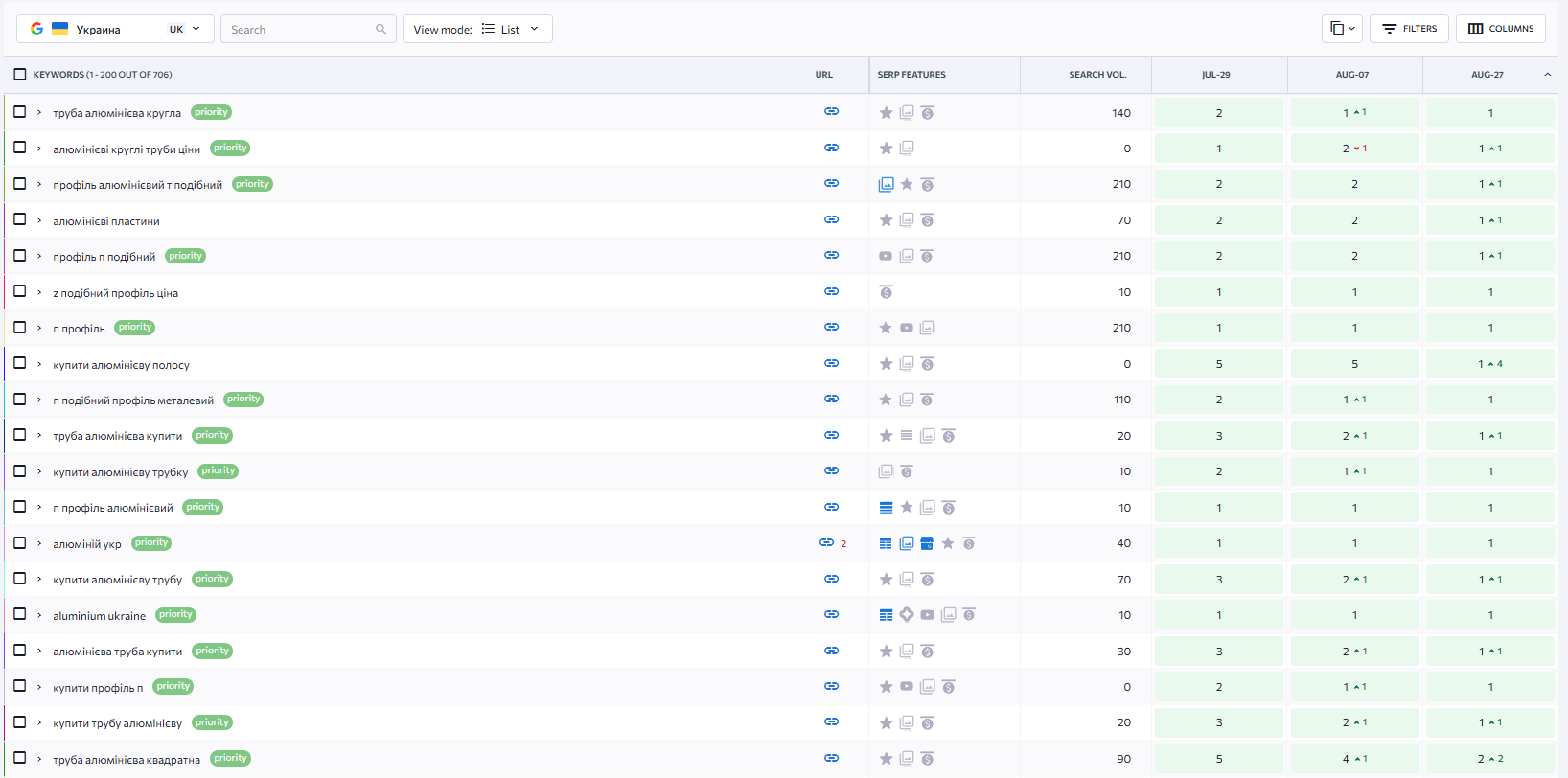

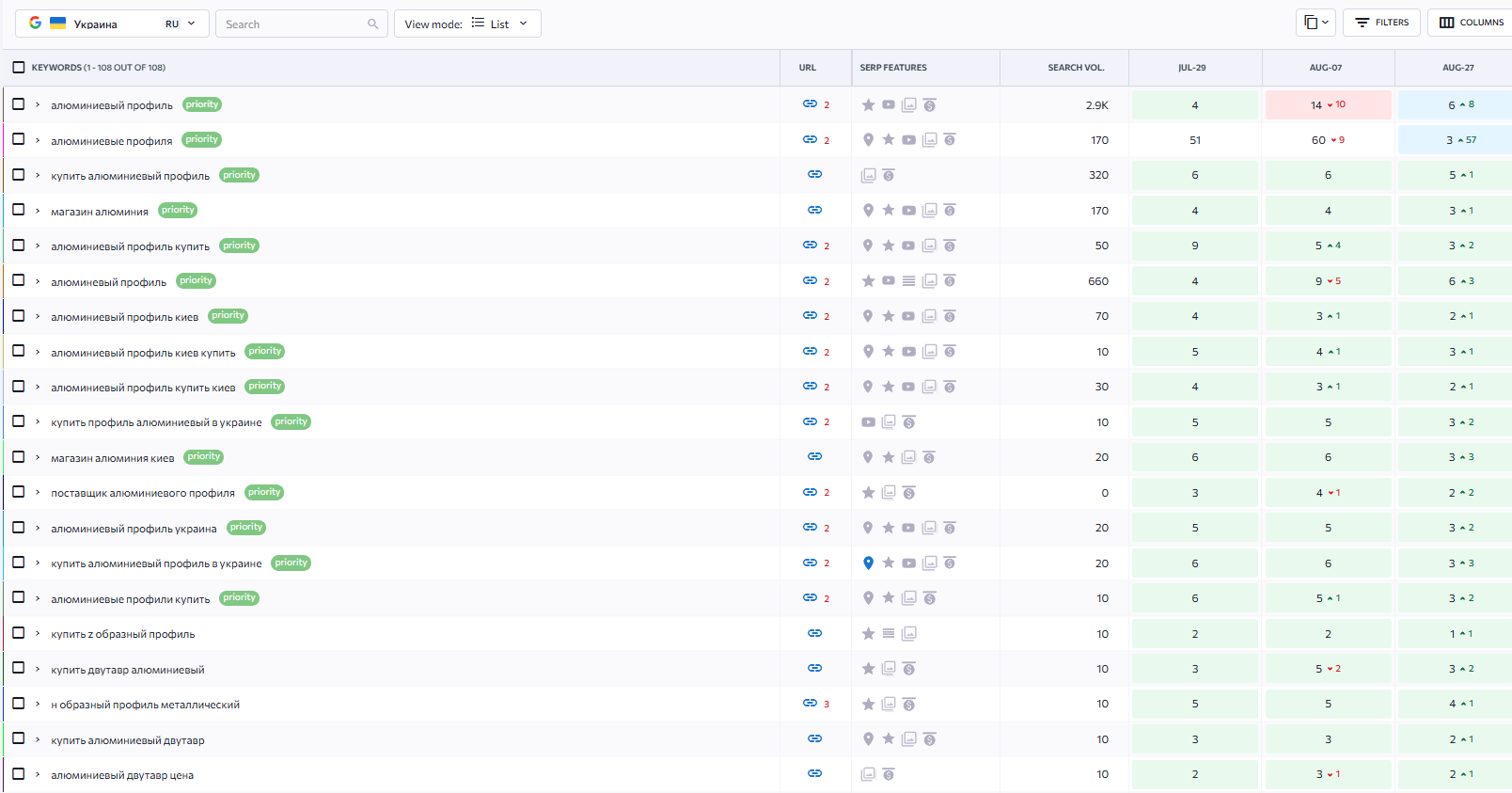

Keyword positions are growing: Ukrainian-language queries

Most tracked keywords, including commercial ones, show steady growth or stable retention. All of them now rank among the Top 3.

The overall trend demonstrates consistent upward movement. The majority of keywords, especially those with commercial intent, continue to rise, entering the Top 5 and Top 10, or are already firmly positioned there.

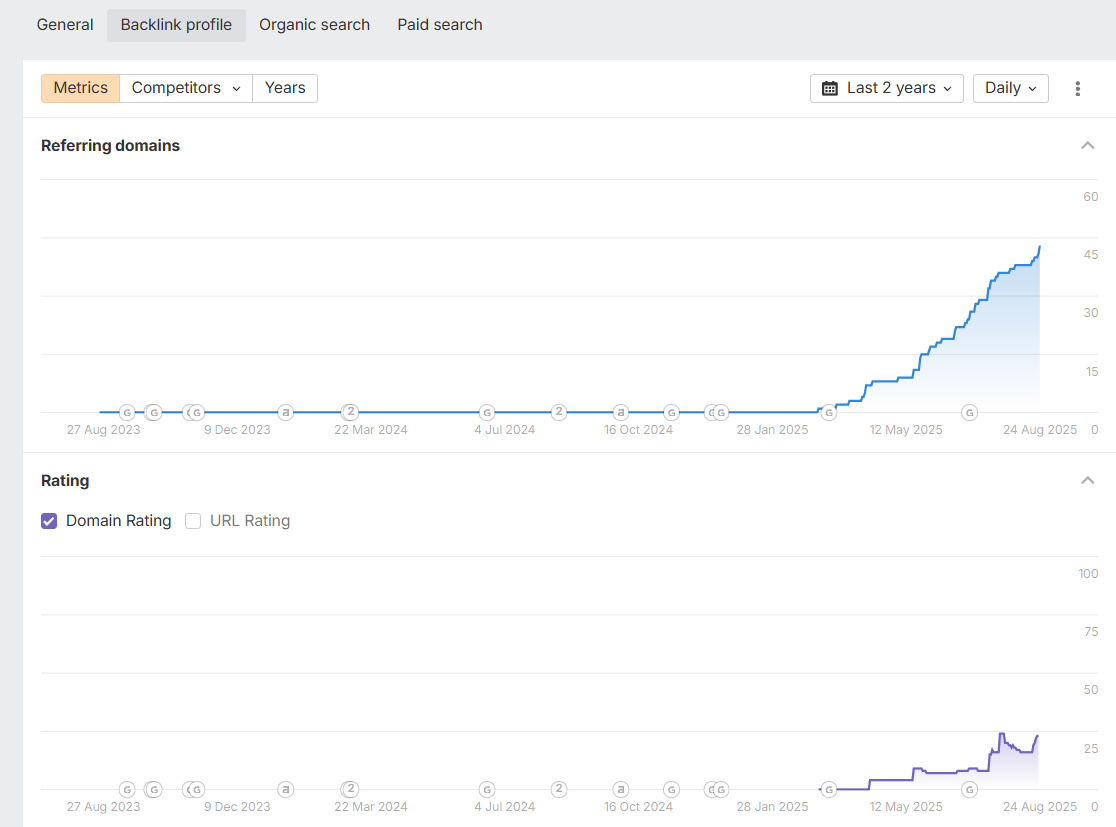

Link-Building strategy

Since the old domain had a large number of disavowed and low-quality referring domains, many of which were dropping off on their own, the number of backlinks on the new domain is still relatively small.

The graph shows a steady and rapid increase in the number of referring domains. Since March 2025, the number of domains linking to the site has been growing consistently, indicating an effective and active link-building strategy. Our link-building approach prioritizes quality rather than quantity. At this stage, the number of referring domains is around 45. These are authoritative and niche-relevant resources for the client.

As the number of referring domains increases, the domain rating also gradually rises. This means that the new backlinks are of high quality and pass authority to the website, which is critical for ranking.

General analysis of the domain migration process

- Duration of the migration. The migration took almost 6 months, which is completely normal for large websites with extensive indexing. The process of reindexing and transferring authority from the old domain to the new one is still ongoing.

- Issues encountered during the migration:

- Competition between domains - the main issue was the “position turbulence”, where both the old and the new domains competed in search results simultaneously. This resulted in instability and a temporary loss of traffic.

- Slow reindexing - the website has been reindexed slowly due to the large number of pages and technical specifics. This slowed down the achievement of positive results.

We are already seeing a noticeable increase in rankings across both language versions of the website. This indicates that search engines have finally consolidated the old and new domains, transferring the full authority to the new one.

The growth in rankings has naturally driven a positive traffic trend. This confirms that the decision to switch domains was the right one, and all technical challenges were successfully resolved.

Our primary goal was to increase the volume of inquiries and sales. While detailed results remain confidential, we can state that the client was delighted with the collaboration. As we continue our work, it is important to highlight that the website now ranks on the first page of Google, with 14 keywords in the top position and 13% in the top 10. This confirms that our strategy led not only to higher traffic and improved search visibility, but also to achieving the client’s core business objectives.

Overall, this case demonstrates that despite temporary challenges, the strategic decision to change the domain proved to be the right one and became a key factor in the project’s long-term success. We continue to work on strengthening and scaling the results.