This case study demonstrates the results of a comprehensive promotion strategy for the online store skin-reboot.com, which specializes in selling Korean and injectable medical-aesthetic products in the US market.

The client set significant enhancement of the website's online visibility, maximization of new customer acquisition, and sales as the main goals of the cooperation. To achieve this, we chose a strategy that combines two key areas:

- Search Engine Optimization (SEO) - building organic traffic, increasing domain authority, and moving the website to the Google TOP for target queries.

- Pay-Per-Click advertising (PPC) - rapid acquisition of high-quality traffic and conversions through Google Ads (Shopping, Performance Max, and Search campaigns).

We will examine the project in this precise order: first, the SEO segment, followed by a discussion of the PPC efforts. This case study exemplifies that the combination of SEO and PPC is an effective strategy for a young project in the US market, enabling it to gain a foothold and ensure high profitability quickly.

About the Client

skin-reboot.com - skin-reboot.com is an online store specializing in selling high-quality medical-aesthetic and cosmeceutical products.

The client positions itself as a supplier of Korean and other professional medical-aesthetic products. This provides a competitive advantage in a niche where Korean cosmeceuticals are highly valued for their innovation and quality.

Main product categories:

Injectable aesthetics:

- Fillers (dermal fillers).

- Meso-injections (for mesotherapy).

- Cosmetic injections (general purpose).

- Skin boosters (products for deep hydration and revitalization).

Cosmeceuticals and Skincare:

- Specialized cosmetics for face and body.

- Skincare products (creams, serums, masks), often Korean-made, are aimed at hydration, anti-aging care, and skin recovery.

The website is focused on serving the US market, which requires careful consideration of local licensing and logistics requirements, especially for injectable products.

We started our cooperation from the website development stage in October 2023. For the new site, SEO was integrated from the very beginning of development, which later allowed us to avoid common technical issues and create a structure optimized for search engines. The client approached us based on a recommendation. The main task is comprehensive SEO promotion of the website, including initial technical optimization, work on structure, content, and the link profile. The goal is to increase organic traffic and improve the website's visibility in search engines for commercial queries corresponding to the range of medical-aesthetic products.

The search promotion budget is managed at a moderate range for similar niches. The budget volume allows for the gradual formation of a quality link profile and maintenance of stable growth dynamics.

SEO

Niche features

The niche of medical-aesthetic products is quite challenging for promotion. The main issue is that not all donors agree to place links to sites with such subject matter - many refuse due to medical or injectable content. Because of this, the link acquisition process can take up to a full month, as it requires careful selection of relevant and safe platforms for placement.

Furthermore, the market is extremely competitive, featuring a large number of similar online stores and distributors. This slows the pace of promotion - results do not appear as quickly as in less saturated niches and require constant position monitoring, a flexible approach to content, and the gradual building of the link profile.

It is also worth noting that the promotion dynamics are influenced by constant changes in the product assortment: the discontinuation of individual products or their temporary unavailability is particularly noticeable when they were highly popular items. Such changes negatively impact traffic and conversion statistics, as traffic directed to these products is lost, and search algorithms may re-evaluate the relevance of the pages.

Along with these factors, the promotion dynamics are also affected by certain technical and operational difficulties on the client's side, which we are jointly resolving step by step.

Competitor analysis

Comparative analysis of key competitor metrics:

- Domain age: ranges from 2 to 5 years. These are relatively young domains that offer opportunities for rapid growth.

- Number of indexed pages: from 468 to 9,560 pages. The leader possesses a very deep content structure.

- Monthly traffic: ranges from 1,054 to 5,157 visits.

- Number of US keywords: from 592 to 1,237 keywords. Successful competitors rank for 1,000+ keys.

- Queries in Google US TOP 10: from 95 (16%) to 295 (32%) queries. The market leader has the highest visibility percentage.

- CMS: various systems are used, including WordPress, Shopify, OpenCart, and custom-built solutions.

- Social Media: the main channels are Facebook and Instagram. Two competitors also actively use YouTube. One competitor is present on Pinterest and Twitter.

- Blog presence: most competitors (4 out of 5) have an active Blog section. This is a standard for the niche.

The analysis shows that the injectable cosmetics niche is competitive but relatively young, offering the client's project significant opportunities for rapid growth. Product pages are the main traffic-generating pages in the niche, and this is our primary focus. It is also advisable to create separate brand pages only where more than one brand product is featured, and if targeted brand queries exist. Category pages will not be promoted, as they usually do not bring significant traffic.

Successful competitors rank for 1,000+ keywords. This means the semantic core must be broad and include not only direct commercial queries but also informational ones.

Blog potential: Although competitors do not use articles properly (resulting in low traffic), the blog can be a valuable source of traffic. Therefore, for a new website, the blog will be activated in the final stage, after the full optimization of product pages and the necessary brand pages. The best competitor achieves 32% visibility in the TOP 10 with fewer pages than the absolute leader. This confirms that content quality (relevance, expertise) is more critical than its quantity.

We also recommended that the client implement a "Before and After" block on product pages, following the example of competitors. This is a good idea for attracting additional traffic and increasing conversion.

Link promotion plays a key role in a niche like this. Special attention should be paid to the quality of donors and the systematic dynamic of link mass growth, which is critically important for a newly created website.

Technical audit

The initial technical audit revealed some critical issues that required comprehensive fixes to ensure proper indexing and improve user experience:

- incorrect operation of the registration form, which hinders new users;

- errors on the Privacy Policy page, which may affect site trust and legal compliance;

- incorrect meta tags (noindex/nofollow) found on key pages, prohibiting search engines from indexing the content;

- the index is cluttered with duplicate pages, particularly those generated by the product-tag parameter;

- issues with default product sorting;

- pagination pages are unoptimized;

- incorrect processing of internal site search results, which complicates the search for the necessary product;

- an inefficient structural problem leading to content duplication: the existence of duplicated pages with identical semantics. This occurs because different volumes of the same product are presented on other URLs.

We proposed implementing the structural solution "Choose an option": unifying products with identical semantics but different volumes into a single product card. The "Choose an option" functionality within a single card allows for dynamic changes to the price and image, as well as displaying a notification when a selection is unavailable. This significantly improves usability and ensures URL optimization (1 product = 1 URL).

Once the website redesign was completed, we immediately began its analysis for further optimization.

Website redesign analysis

The analysis of the new redesign revealed the need for refinements. We compiled a complete list of recommendations for correction and transferred it to the client's team for implementation.

1. Navigation and Menu

- Missing link to the blog: a direct link to the Blog section is missing from the menu in both desktop and mobile versions.

- Dropdown menu: in the desktop version, hovering the cursor over the “Shop” link in the header does not display a dropdown menu for quick category viewing without navigating to the section page.

- Breadcrumbs: absent on all website pages starting from the second level of nesting.

2. Homepage and Banners

- Homepage banner size: the banner on the Homepage takes up too much space in the desktop version compared to the mobile version. It is recommended to optimize its size.

- Internal linking on banners: working links are missing.

- Block visibility: all blocks on the Homepage must be filled with content or should not be displayed if there is no possibility/necessity to fill them.

3. Product cards and Catalog

- Category H1 headings: headings are missing in categories (the category name is absent on most pages, and where it is present, it is not marked with the H1 tag).

- Product name positioning: in the mobile version of product card pages, the product name must be moved before the photo or added as the last non-clickable element in the breadcrumbs.

- Mandatory category: all products on the website must be assigned a corresponding catalog category.

- Photo block optimization: the photo block on the product card page takes up too much space on desktop. Its optimization is recommended.

4. Footer, Social media, and other elements

- Phone number clickability (footer): the phone number must be made clickable in both mobile and desktop versions.

- Link to blog in the footer: add a link to the Blog in the "Help & Info" block.

- Social media: working links must be inserted into the social media icons, or the icons should be removed before release if accounts are not yet available.

- Blog: remove the Website field from the commenting form in blog articles.

- About Us page: remove or replace the template text in the block on the right.

We forwarded the specialists' recommendations to the client for refinement, and the next website audit was conducted just before its release.

Audit before release

The audit revealed the following errors:

1. Indexing and crawling issues directly influence how search engines perceive and rank the website.

- Presence of garbage pages: subsequent crawling revealed that some links generate a large number of garbage pages (parametric URLs, non-target filters, etc.) that clutter the index.

- Sitemap (Sitemap.xml):

- Contains redundant pages that should not be indexed.

- Automatic sitemap updates should be configured.

- All target (landing) pages with server response code 200 (OK) must be added to the sitemap.

- Removal of unnecessary elements: the generation of RSS feeds must be removed.

- Problematic URLs: links such as /cart/?remove_item= (cart URL with parameters) must be removed.

2. Response codes and redirects

- Internal redirects: internal 301 redirects were detected on the websit

- Error handling:

- For non-existent pages (404), the correct server response code 410 (Gone) must be set if the page is permanently deleted, instead of 404 (Not Found).

- 301 redirects must be set up for pages that have been moved or merged (to preserve link equity).

3. Code and microdata

- Localization:

- The HTML lang attribute, which defines the document language, was found in the page code: lang="en-GB".

- The Open Graph microdata contains an incorrectly set og:locale meta tag.

- Errors in the microdata code.

- Load speed: issues with website loading speed were identified (requires optimization).

4. Usability (UX) and navigation

- Breadcrumbs: implement Breadcrumbs on all website pages, starting from the second nesting level.

- Subscription forms:

- The subscription form is missing on the Homepage.

- The existing subscription form needs adjustment (correct errors and improve the design).

- Global banner: a cross-cutting link to the search page is present in the global banner.

Based on the comprehensive audit conducted (technical, indexing, and usability analysis), all detected errors and recommendations were transferred to the client's team for refinement. The correction of these remarks is critical for the successful start of SEO promotion and the effective operation of advertising campaigns.

Link-building

Analysis of competitors' link-building strategy:

- Leading domains have a Domain Rating (DR) in the range of 30-36.

- Competitors have acquired between 44 and 237 unique referring domains.

- Competitors direct between 12% and 64% of their link mass to the Homepage.

- Dofollow: 4 out of 5 competitors have a high Dofollow percentage (61% – 96%).

- Nofollow: The minimum Nofollow percentage is observed in two competitors - 4% and 8%.

- The competitor leader has the largest number of links (2.2K) but the lowest Dofollow percentage (22%) and the highest Nofollow percentage (78%). This likely indicates a significant volume of automated or forum links.

- The Dofollow quality leader has 96% Dofollow links, and another competitor has 92%; they demonstrate the least "natural" (most aggressive) profile.

For a new website in the injectable cosmetics niche, it is critical to adhere to a cautious and high-quality link-building strategy. Link acquisition must be smooth, without sudden spikes. This is especially vital for new sites, as a rapid increase in links can trigger suspicion from search engines (link-buying filter). We must maintain a natural link acquisition process to ensure stable growth.

The natural ratio of link attributes should be adhered to:

- Dofollow: 70–80% of the total link mass. These are the links that pass authority to your website.

- Nofollow: 20–30% of the total link mass. This is necessary to mimic a natural profile, as, in reality, not all acquired links are dofollow.

At the start of the work, the overwhelming majority of links must be directed to the website's Homepage. This will help rapidly build the overall domain authority. After providing sufficient authority to the Homepage, we planned to gradually add links to the product pages, as they are the main target pages for traffic promotion. We will focus not on the quantity but on the quality of donor resources. And select resources with a high rating (domain authority) and targeted traffic from the US, as this is our key GEO.

Work process

The website was opened for search engine indexing in April 2024. The final site release was delayed due to setbacks related to filling product cards with optimized descriptions. Since the site was created from scratch, no significant deletions were performed - on the contrary, we developed and implemented the catalog structure and corrected the navigation for better usability.

Also, two key technical solutions were implemented before the release to speed up website loading:

- WebP image format: a plugin was installed and configured to automatically create and use WebP images. This will significantly reduce file sizes.

- Full caching (LiteSpeed Cache): The LiteSpeed Cache plugin was installed and configured for full page caching. Targeted cache clearing was also set up: when any product is modified, the cache is automatically cleared for its card and the corresponding category.

Also, to avoid conflicts and optimize performance, redundant caching and optimization plugins - jetCache and Autoptimize - were removed.

Semantic core development

When compiling the semantic core for skin-reboot.com, the specifics of a new website with no history and no rating were taken into account. The main emphasis was placed on low-frequency and low-competition queries, as these allow for faster achievement of initial rankings and stable traffic due to lower competition. In the initial stage, priority was given to queries related to specific products, rather than general or high-frequency ones, which require more external links and domain authority.

We also planned to gradually add brand-related queries if the catalog featured multiple products from one brand - this would allow for the creation of separate brand pages and the acquisition of additional targeted traffic.

Therefore, the main semantic core strategy is to start with low-frequency queries, ensure stable growth of website visibility, and gradually transition to medium-frequency queries as search engine trust in the resource increases.

Link strategy

For a new website, there are certain specifics when building link mass. Due to the niche specifics, some donors refuse to place links to the website, so selecting quality platforms and placing links can take longer than in standard subject areas.

Consequently, link acquisition is carried out gradually, with careful verification of each resource based on traffic, geo, and quality metrics, to maintain natural growth dynamics and avoid risking the website's reputation.

The budget size does not limit the choice of optimization methods. We have sufficient resources to implement the planned promotion stages from link acquisition and content creation to technical optimization. The budget allows us to operate within the developed strategy without needing to curtail or postpone planned work.

The client fully trusts our expertise and generally implements all recommendations provided within the scope of promotion. The cooperation proceeds in an open format, with regular discussion of changes and priorities.

During the work, situations occasionally arose where specific edits were made to the website without prior coordination; however, they did not critically affect the results or the technical state of the resource. In such cases, we promptly coordinated the details and introduced the necessary corrections to maintain consistency in our work and ensure the stable development of the website.

During the work on the project, the following services were used in addition to Google Analytics:

- Ahrefs - for collecting the semantic core, analyzing competitors, developing the link strategy, and selecting quality donors for external promotion.

- Serpstat - was also used to verify the completeness of the semantics and clarify search demand based on keywords.

- Hotjar - was used at the initial stage to analyze user behavior on the website (heatmaps, clicks, scrolling), which helped identify potential UX improvements and make the website more convenient for visitors.

Search promotion results

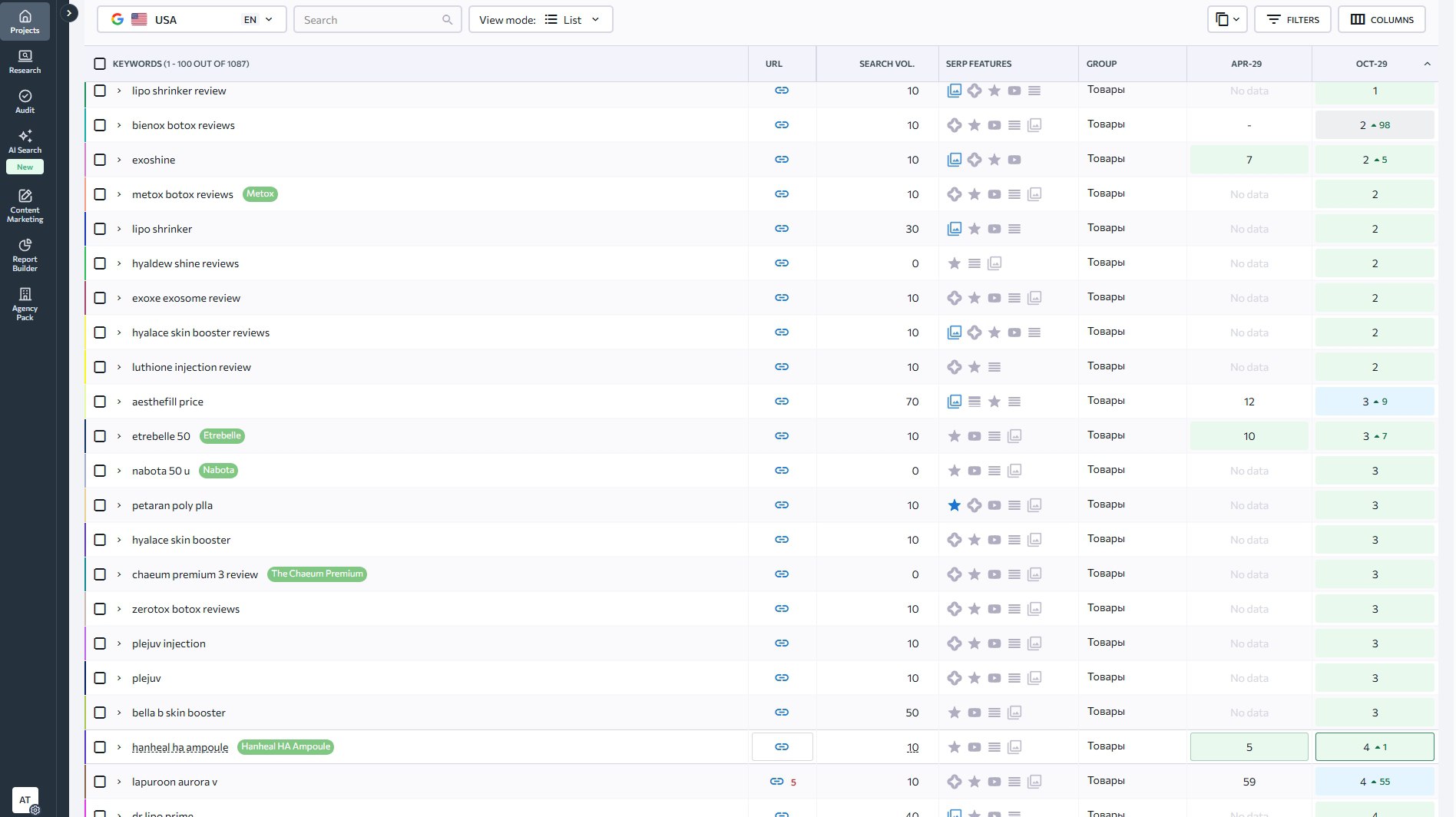

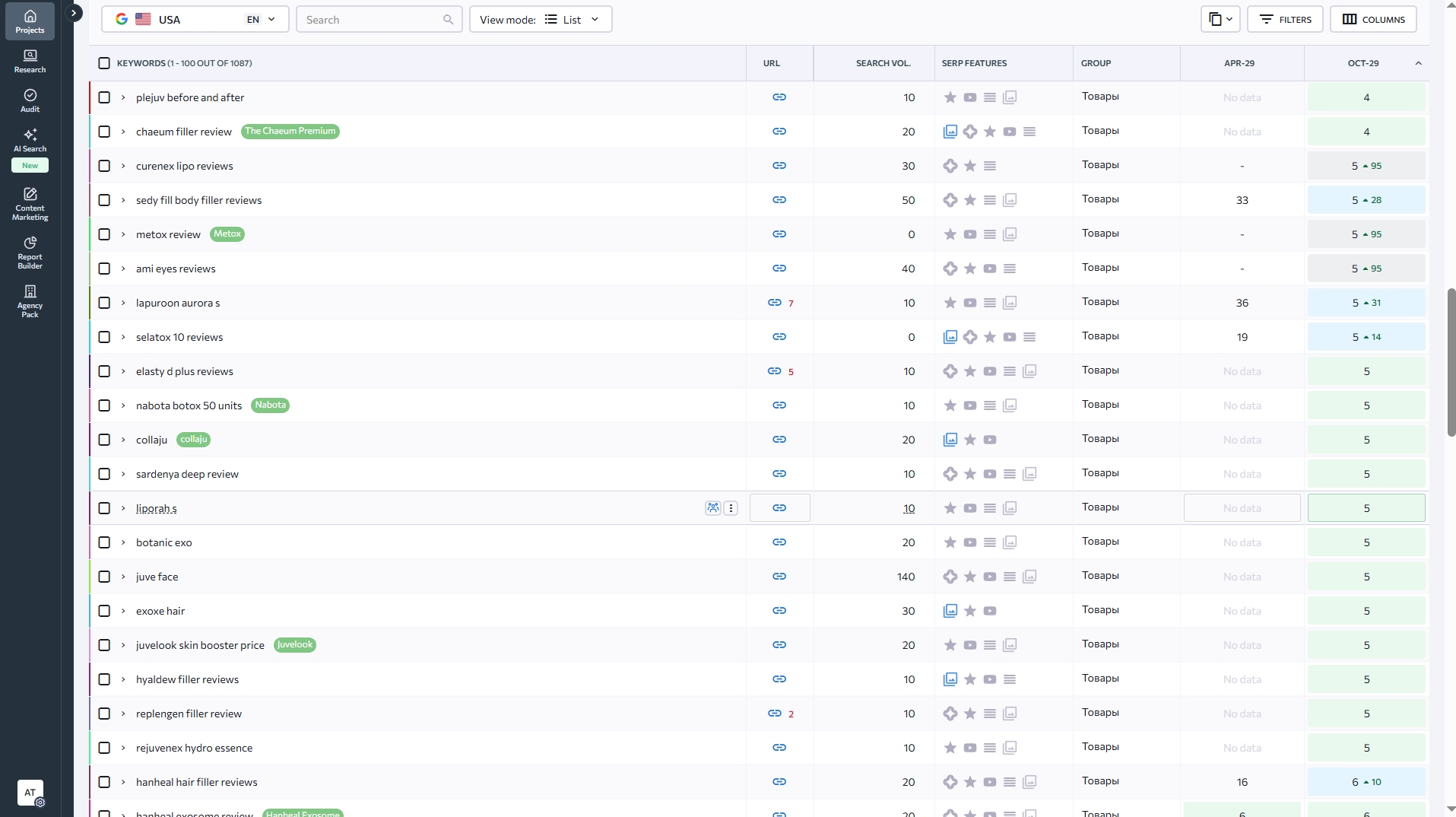

Semantic core

Growth is occurring uniformly across all segments, indicating a systematic and balanced approach to content management.

A sharp increase in queries across all segments is observed from July to October 2025, which is a direct consequence of the active link-building phase and the indexing of optimized content.

The most significant result is the gain of 18 queries in TOP 2-3 and the almost complete filling of the TOP 10 with new positions (+85 queries overall). This confirms that the content is relevant and high-quality, and the website is successfully gaining positions in the highly competitive zone.

The TOP 11-30 segments (+183 queries) serve as a powerful "reserve" for further growth. Further work on these pages will allow them to be pulled into the TOP-10.

The analysis of key phrase dynamics demonstrates that, thanks to comprehensive content work and the buildup of the web resource's authority, we successfully moved the majority of target queries into the TOP of search results, significantly enhancing the website's organic visibility.

Several queries that were previously in low positions or undetected have entered the TOP-3 or are showing significant growth. This includes certain commercial queries that are now in the TOP-3 and are driving targeted traffic growth. Many queries that previously had an ND (Not Detected, not ranking in the TOP-100) status have appeared in the visible part of the search results (TOP-2, TOP-3). This confirms that the implemented content strategy has worked.

The content strategy is effective because queries related to specific products have reached the TOP 3. The growth from ND and TOP 10 positions to TOP 3 positions demonstrates that, thanks to increased link mass and high-quality content, the website has acquired the authority necessary to rank in the highly competitive search results.

Link-building

Active growth of the website's link profile commenced in April 2024.

Since that time:

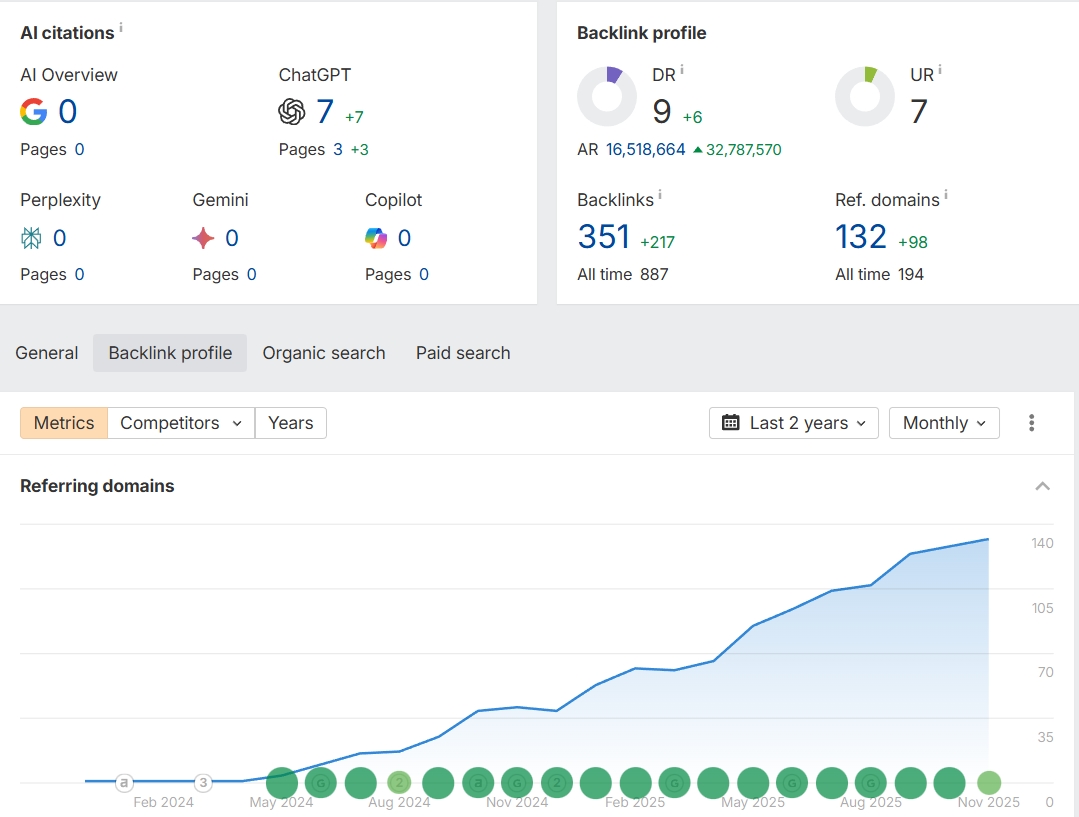

- over 350 backlinks have been acquired from approximately 130 quality donors,

- the Domain Rating (DR) metric has increased by 6 points and currently stands at DR 9,

- URL Rating (UR) - 7.

The chart below shows a gradual, stable increase in the number of referring domains without sharp fluctuations, indicating smooth and safe link mass building focused on quality sources.

The chart shows slow but stable growth in the number of donor domains, which corresponds to the smooth, safe link building necessary for a new website.

The strategy of gradual link building, especially at the start, has been successfully implemented. The sharp increase in the number of donor domains (from 34 to 132) demonstrates effective and scalable link-building efforts. The rise in DR from 3 to 9 is acceptable progress for a young website. We also see that the client's website appeared in the ChatGPT AI search results 7 times. Successful acquisition of referring domains is the correct priority, as this metric has the greatest impact on the overall domain authority in the eyes of search engines. The significant growth in the number of domains (+98) and links (+217) confirms that the link profile is actively developing, which is a key condition for maintaining the high effectiveness of advertising campaigns and further organic growth.

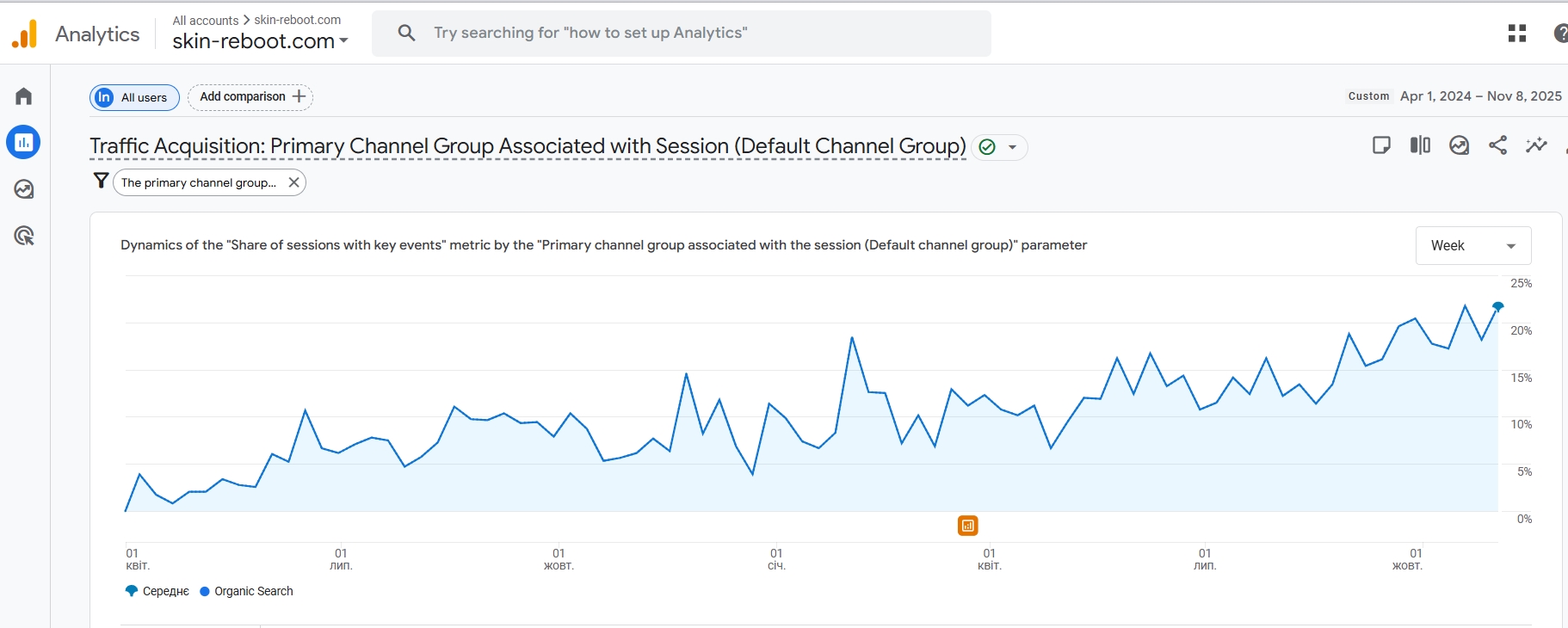

Organic traffic

Initially, let us review the total volume of acquired traffic.

The successful launch of the website for indexing (April 2024) and the correction of critical errors laid the foundation for crawling and subsequent growth, as evident from the start of the chart - a clear, stable upward trend is visible throughout the entire period. A certain rhythmicity is observed with regular peaks and troughs, which may be related to both seasonal demand and the periodicity of new content releases or Google algorithm updates. The acceleration in the acquisition of donor domains coincides with the period of accelerated organic traffic growth and its attainment of peak values. The stable increase in traffic, particularly in the latest period, indicates that the optimized product descriptions and the developed catalog structure are yielding results. The positive dynamic on a young domain suggests that the website is successfully competing in a niche where, although competitors have a large volume of content (up to 9,560 pages), the client's content, which focuses on quality and conversion, is effective.

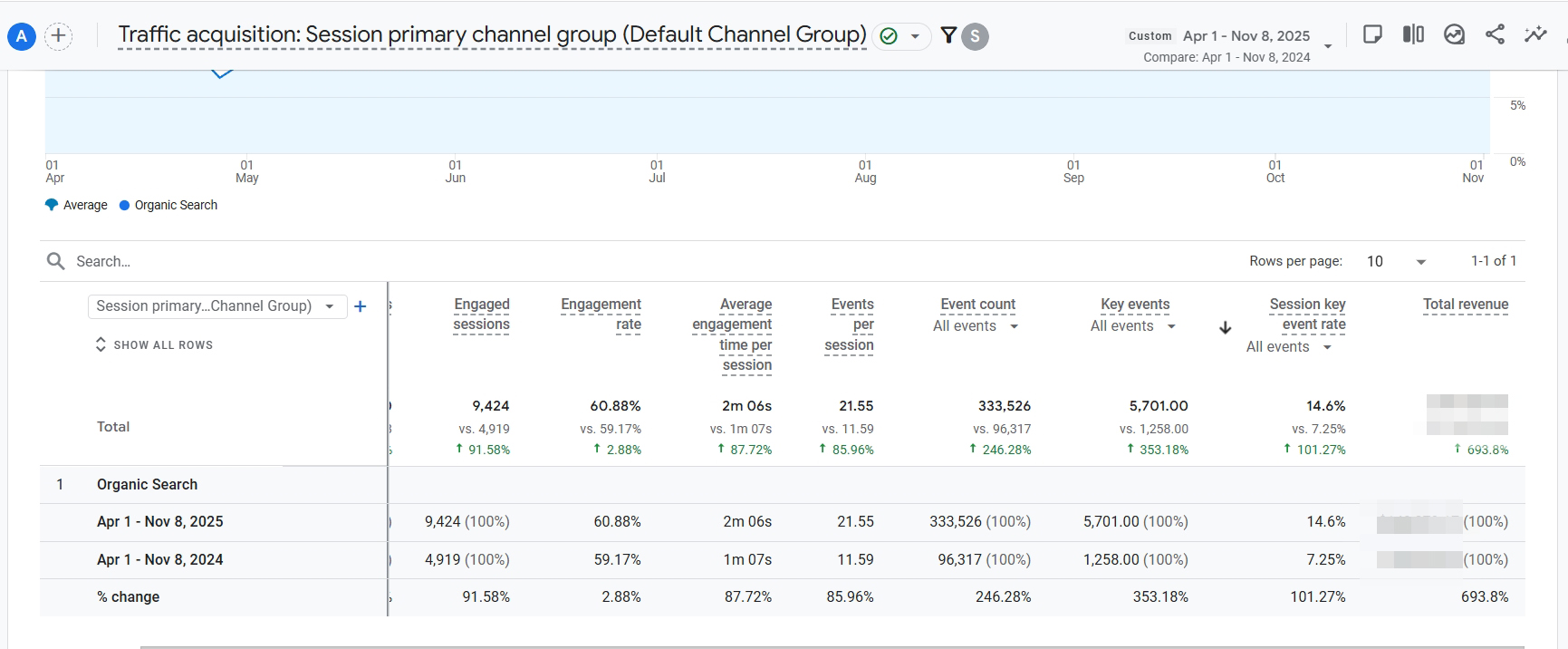

Compared with the 2024 and 2025 periods, an exceptionally positive dynamic is observed in organic search.

The number of engaged sessions has almost doubled (+91.58%), which indicates successful link mass building and effective indexing of new content. Traffic quality also improved: the sharp increase in Average Session Duration (+87.72%) to 2 minutes 06 seconds is a key indicator. This means that the content has become significantly more relevant and better meets the queries of users arriving from search.

The increase in Key Events by +353%, Events per Session (+85.96%), and Key Event Rate by +101% (to 14.6%) confirms that:

- the correction of technical and usability errors eliminated barriers to conversion;

- optimized product descriptions and improved catalog structure effectively convert traffic into targeted actions.

The +693.8% growth in Total Revenue is the most critical financial result. This indicates that not only were more users acquired, but they also interacted more actively with the website and performed targeted actions significantly more often. The organic acquisition channel has turned into a high-profit asset.

The implemented SEO strategy (gradual link building, content expansion, and elimination of technical errors) has been extraordinarily successful. Over the course of a year, organic traffic doubled, its quality sharply increased, and the financial result grew almost 8-fold. This confirms that the chosen focus on content quality and link mass building has become the key to success in the competitive US market, and the website has successfully secured its position in Google's organic search results.

PPC

We began preparations for the project's advertising launch in October 2023. However, we fully launched the advertising campaigns in June 2024, as the client was engaged in the website redesign until April (as mentioned in the Search Promotion section).

The project's advertising campaigns were launched from scratch, requiring comprehensive preparatory work that became the technical foundation for subsequent efforts.

Google Ads campaign launch plan

In the initial stage, to ensure the possibility of launching advertising and accurate tracking, we first created a Google Ads account. We then provided recommendations for website corrections.

General initial scope of work

1. Technical preparation of the website and tracking is the foundation, as we will not achieve good results without quality tracking and site compliance.

- Google Analytics 4 and Google Tag Manager:

- Create and connect the resources.

- Set up all necessary conversions via GTM.

- E-commerce:

- Recommend setting up e-commerce tracking to improve advertising performance.

2. Setting up Shopping campaigns (Google Shopping) after the website is ready:

- Merchant Center creation:

- Create and set up the Merchant Center (this is done after site refinement to obtain approval from Google immediately).

- Campaign launch:

- Set up and launch a standard Shopping campaign.

- Launch Performance Max after collecting sufficient conversion data (approximately 2–4 weeks after the start of Search and Shopping campaigns)..

3. Launching the Search campaign - this is our second main channel for acquiring conversions.

- Semantic core and keywords:

- Use the keywords provided by the client as a basis and add new queries related to new products.

- Texts and extensions:

- Write completely new, engaging ad copy and create all necessary extensions.

4. General campaign settings - the starting point.

- Geography:

- Focus on the list of states provided by the client.

- Schedule:

- Show ads 24/7.

- Devices:

- Displays on mobile devices and PCs.

To ensure user trust, improve navigation convenience, and comply with all Google Merchant Center requirements, we recommended that the client make several important corrections to the website.

Website optimization recommendations

1. Improvement of contact information and user trust - to confirm transparency and legitimacy, the website must ensure easy access to core company data:

- The full physical address of the company must be added to the Contacts section. This is a critical requirement for successful moderation in the Merchant Center.

- For user convenience and standard compliance, the phone number, email address, and working hours should be duplicated in the website footer.

- Direct links to the key Contacts and About Us pages should be added to the footer for quick access from any page.

2. Detailed Delivery and Payment terms - sections must be maximally detailed to avoid customer questions and the blocking of advertising campaigns.

- A separate Payment section should be created and linked to in both the top menu and the website footer. All available payment methods must be clearly described on the website.

- The Delivery page must clearly outline the geography of sales and delivery.

- Special attention is required for international delivery: the shipping service, estimated delivery times, and shipping costs (or the terms for calculating them) must be specified for each region or country where goods are shipped. The more detail, the better.

3. Optimization of Navigation - to improve the user experience and internal site structure, it is recommended to add a link to the “Catalog” (which leads to the /shop/ page) in the website footer. This will ensure easy access to products from any location.

Advertising сampaigns

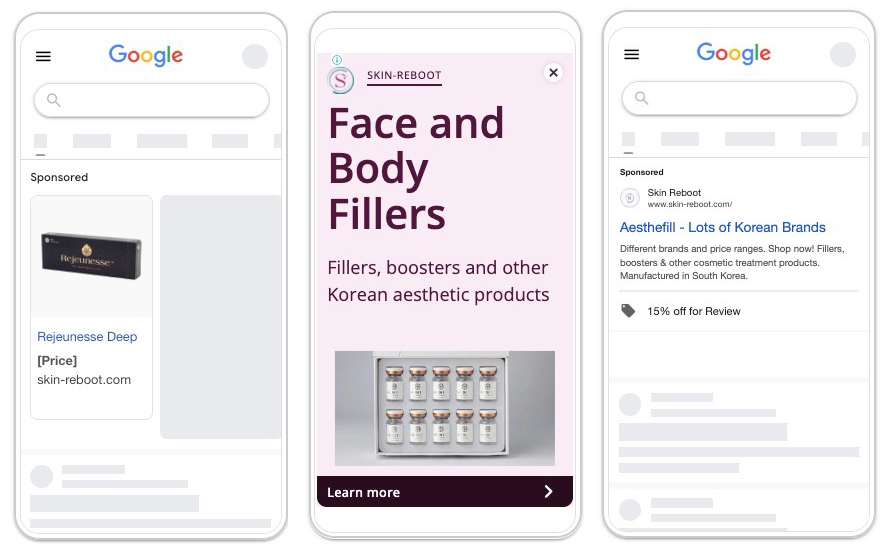

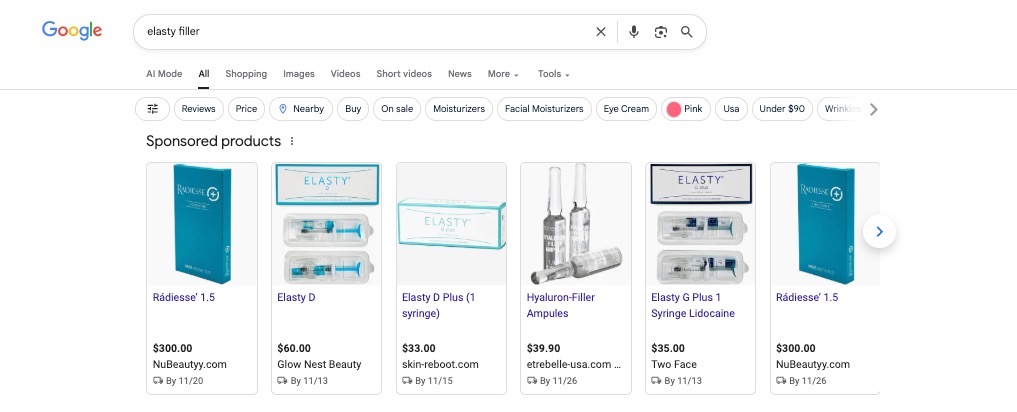

Competitor analysis showed that the most relevant competitors focus their main advertising resources on product and search displays in Google. Therefore, we proposed launching Search and Shopping advertising campaigns for the client. After 3 weeks of running the Search and Shopping campaigns, we also launched Performance Max with a product feed.

Initially, we selected the add_to_cart and purchase conversions, imported from the GA4 interface, as the main goals for the advertising campaigns. We decided to add add_to_cart as a primary conversion temporarily to gather more conversion statistics in the account. After 1.5 months of running the campaigns, we moved the add_to_cart conversion to the Secondary conversions category.

Features of the settings

In the current niche, it is quite common to encounter product and ad disapprovals due to restrictions on impressions for certain products within the Google Ads network. Moreover, these restrictions tend to expand, meaning the list of products that cannot be advertised via Search/Shopping sometimes grows. It is necessary to carefully monitor the status of ads and assets to avoid blocks.

Since some products cannot be advertised through Search campaigns due to Google Ads restrictions in this niche, and some products are disapproved in the Merchant Center, we launched Performance Max campaigns without a product feed but with a page feed for such product items (the page feed contains products that cannot be advertised in Search/Shopping campaigns). To cover the target audience for items with restrictions on direct use in keywords, we use Performance Max campaigns - we add these restricted terms as search themes and create specific custom audiences in signals. These campaigns (URL_Feed) in the account are what drive traffic for such queries.

Also, during the cooperation, there were instances when, due to internal reasons, some products that brought a significant share of conversions had to be removed from displays. This led to a disruption of the launched campaigns' algorithms, requiring us to restart them. Sometimes, strategy algorithms "fail" even without such major changes, so we occasionally restart advertising campaigns.

As of autumn 2025, we have opted out of Search and Shopping campaigns. Currently, only PMax campaigns are running in the account (3 campaigns with a product feed and 1 with a page feed).

Account blocking

Just as we finished setting up everything and launched the displays, we received an account block on April 22, 2024. Possible reasons:

1) Infected website (source).

2) Prohibited products - the final URLs contain the name of a prohibited product, botulax; this product is on all landing pages as it is included in the bestsellers section.

To unblock the account, we needed to reinstate the disapproved ads and then submit appeals for account restoration.

The likely first reason for the block could have been the absence of a consent mode banner for data collection or website errors. Therefore, the client needed to add a banner and check the site for errors.

To solve problem №2, botox and other products prohibited for advertising must be removed from display on all website pages - they should be removed from the Bestsellers section and replaced with products permitted for display.

After implementing Google's recommendations, we submitted appeals for the ads, and following successful moderation, we submitted an appeal for the account.

Meanwhile, the client verified the advertiser's identity and payment details. Also, in March 2025, we worked on launching advertisements for wholesale products, starting with a Search campaign, but suspended it in July due to unsatisfactory results. In September 2025, due to low effectiveness, the Shopping campaign was also suspended.

General optimization and Ad settings adjustment work

- Adjustment of campaign budgets and strategies:

- Regular correction of campaign budgets and strategies.

- Change of the PMax campaign strategy to Maximize Conversions.

- Correction of budgets for PMax campaigns depending on current goals.

- Working with system recommendations:

- Relevant system recommendations were applied - non-relevant ones were dismissed.

- Working with search queries:

- Non-target queries added to the negative keyword list.

- Target queries added to the keyword list.

- Suspension of ineffective elements:

- Suspended keywords with high cost and no conversions.

- Suspended less effective products.

- Suspended less effective asset groups/campaigns in Performance Max.

- Suspended advertising for certain brands' products.

- Suspended wholesale Search campaign (after launch).

- Suspended keywords and ad groups with high costs and no conversions.

- Suspended Shopping campaign for geo 2 (due to inefficiency).

Work with search campaigns

- Keywords:

- New keywords selected and added.

- Separate URLs added for certain keywords.

- Ads:

- Improved the quality of responsive ads.

- Added new extensions (logo, campaign name, promotion, images, callouts).

- Added descriptions for sitelink extensions.

- Configured Promotion extension (general, -12% for first order, -30% for Black Friday).

- Campaigns launch:

- Configured and launched a wholesale search campaign.

Work with Merchant Center and Product Campaigns (Shopping/PMax)

- Setup:

- Merchant Center configured, product feed added.

- Shopping campaign configured and launched.

- PMax campaign with a configured and launched feed.

- PMax campaign with a page feed configured.

- Additional PMax campaigns configured (targeting specific states, categories with low impressions, products from certain brands, and URL feed for geo 2).

- Shopping campaign for geo 2 configured (subsequently suspended).

- PMax campaigns restarted (for geo 2 with feed, for geo 1 with feed).

- Product optimization:

- Regular checking of products in the Merchant Center (for availability, for compliance).

- Less effective products are excluded from displays.

- Appeals submitted for disapproved products.

- Replacement of ID/links for disapproved products in Merchant Center.

- Optimized product attributes (titles, descriptions, brand).

- Performance Max optimization:

- Added new asset groups with new signals (including new search themes and audiences).

- Adjustments made to audience signals.

- Review and exclusion of irrelevant ad placements conducted.

- Less effective asset group in PMax is suspended.

- Appeal submitted for asset groups with restrictions.

Tracking conversions and audiences

- Conversions setup:

- Enhanced conversions tracking is configured.

- Purchase conversion via Ads (Purchase Ads) is configured and set as primary.

- Add to cart conversion via Ads (Add to cart) is configured and marked as secondary (for audience collection).

- Working with audiences and remarketing:

- Remarketing tag added.

- Audiences added for observation.

- New audiences configured in Analytics (specifically, users who added to cart but did not purchase).

- Audience configured in Ads for users who added to cart within 30 days.

Other

- Work was carried out to unblock the account and reinstate disapproved ads.

- Microsoft Clarity was installed on the website for user behavior analysis.

The client's team demonstrates high operational speed in implementing all provided recommendations. The client supports an experimental approach and is always open to proposals for increasing effectiveness, so we have no obstacles to increasing the advertising budget within reasonable limits.

Advertising performance results

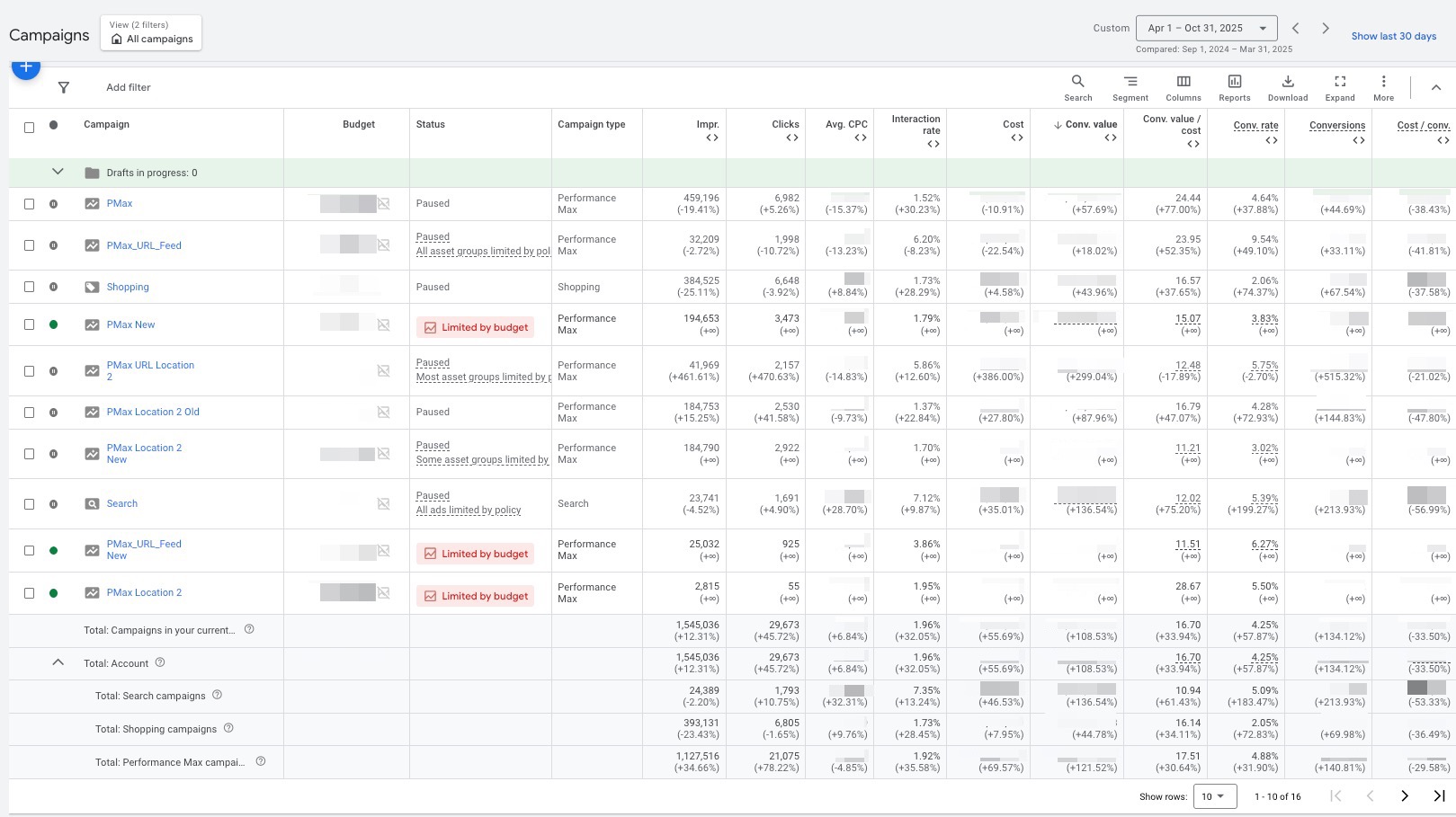

Let us first review the overall period from September 2024 to October 2025 (for a clear presentation of the number and cost of conversions, as the add_to_cart conversion was still counted as primary until the end of July).

- 2 920 719 impressions;

- 50 036 clicks;

- 1.73% interaction rate;

- 15.04 conversion value;

- 3.62% conversion rate.

The 3.62% conversion rate is an excellent indicator for e-commerce overall, which confirms the quality of the traffic and the relevance of the ads. The 1.73% interaction rate is within the normal range.

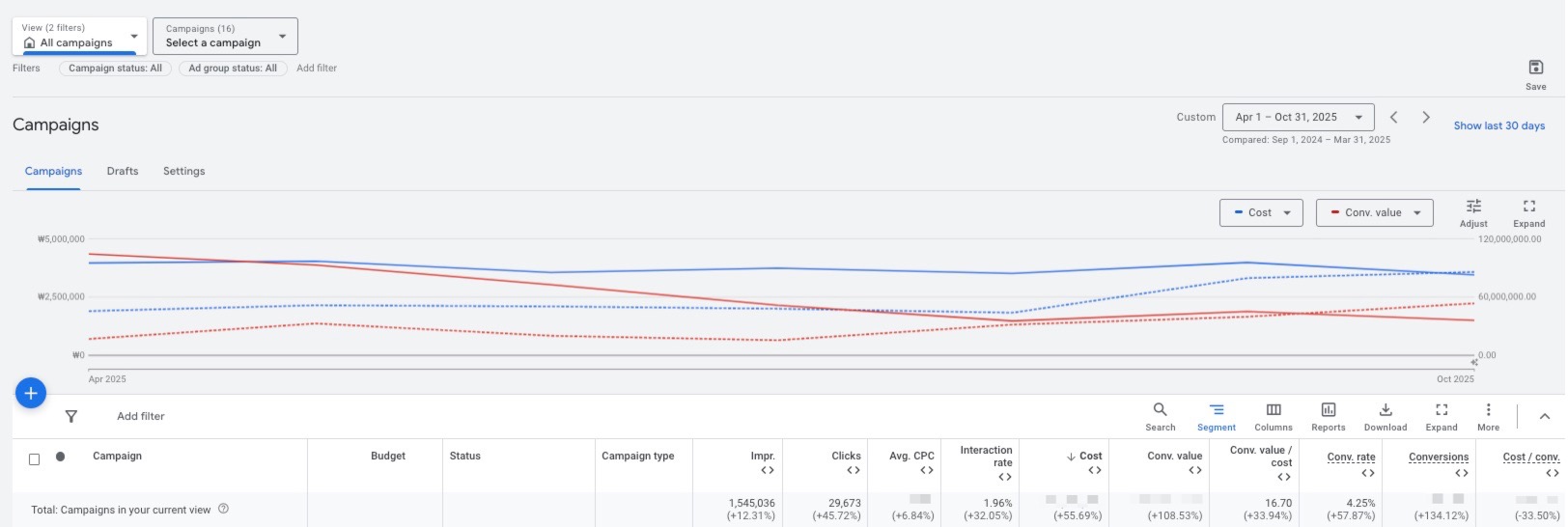

Comparison of periods 1.04 - 31.10.2025 and 1.09.2024 - 31.03.2025:

- +55.69% in advertising cost

- +108.53% in conversion value (purchases)

- +33.94% in profitability

- +57.87% in conversion rate

- +134.12% in the number of conversions

- -33.50% in cost per conversion.

Campaign performance in the current period is significantly more effective than in the previous one. An increase is observed in clicks (+32%) and conversions (+134%) alongside a controlled increase in CPC (+6.8%). This resulted in a sharp growth in return on investment (+33.94%). The chart shows that the conversion value is consistently higher than costs, and the tendency for the gap between them to widen is increasing, which indicates successful optimization.

Conversion value (purchases) increased by 108.53%:

The increase in profitability by +33.94% and the growth in conversions by +134.12% confirm that the current period was significantly more effective than the previous one, owing to quality optimization. PMax demonstrates the best value growth (+21.52%) and high conversion growth (+91.68%), making this campaign type the most promising channel for scaling. Search campaigns were also highly profitable (ROAS 10.94). Conversion growth in Search reached +134.12%.

All campaign types are highly profitable (Conv. value/cost > 10). Performance Max is the main driver of profitability, with PMax showing the most exceptional dynamics of efficiency growth. This indicates the success of the chosen optimization strategy and the website's high conversion readiness.

The coordinated launch and constant optimization of pay-per-click advertising ensured immediate profitability for the project in the US market. Performance Max and Shopping campaigns demonstrated extraordinarily high return on investment (ROAS 17.51 and 16.14, respectively). Moreover, our strategy of using restricted terms had a significant effect - PMax_URL_Feed proved to be the most dynamic (both campaigns show significant efficiency growth). Overall, PPC campaigns significantly improved financial results, resulting in a +134.12% growth in conversions with a stable increase in budget.